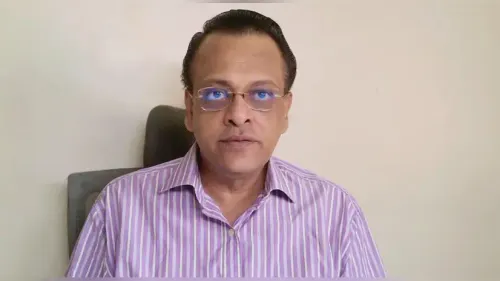

The stock market is a realm of high stakes, where analysts and traders make bold predictions daily. Few admit when they’re wrong—but Sushil Kedia, a well-known market analyst and founder of Kedianomics, recently set a rare example by publicly acknowledging a flawed forecast. His “Majj” (Market Adjustment) theory, which predicted a major market correction, did not materialize as expected.

What makes this story noteworthy is not just the failed prediction but Kedia’s graceful apology and the unexpected appreciation from Raj Thakare, a vocal critic and rival analyst. This blog explores:

- What was Kedia’s “Majj” prediction?

- Why did it fail to play out?

- How did Kedia handle the fallout?

- Why did even Raj Thakare praise his accountability?

What Was Sushil Kedia’s “Majj” Prediction?

In mid-2024, Sushil Kedia introduced his “Majj” (Market Adjustment) theory, forecasting a significant downward correction in Indian equities. His key arguments included:

1. Overvaluation Concerns

- Kedia believed Indian markets were overheated, with stretched P/E ratios.

- He cited excessive retail speculation and FII selling pressure as red flags.

2. Technical Indicators

- His analysis pointed to bearish chart patterns (Head & Shoulders, rising wedge breakdown).

- He warned of a 10-15% Nifty correction, possibly dipping below 21,000.

3. Macroeconomic Triggers

- Global recession fears (U.S. Fed rate hikes, China slowdown).

- Domestic factors (election uncertainty, rising oil prices).

Market Reaction

Many traders took his warnings seriously, with some exiting long positions or shorting the market.

Why Did the “Majj” Prediction Fail?

Contrary to Kedia’s forecast, the Nifty not only held firm but rallied to new highs. Key reasons:

1. Strong Earnings Season

- Corporate profits beat estimates, supporting valuations.

- Banking and IT sectors outperformed.

2. FIIs Returned to India

- Foreign investors reversed their selling streak due to stable macros.

- India’s growth outlook remained stronger than other EMs.

3. Retail & DII Buying Sustained Markets

- Domestic mutual funds saw record SIP inflows.

- Retail traders ignored correction calls, buying the dip aggressively.

4. Global Markets Stabilized

- The U.S. avoided a recession; Fed signaled rate cuts.

- China’s stimulus measures eased global risk-off sentiment.

Sushil Kedia’s Public Apology: A Rare Move

Instead of doubling down or staying silent, Kedia took to social media (X/Twitter) to admit his error:

“My Majj call did not play out. Markets proved me wrong. I accept it humbly and apologize to those who followed my view. The discipline of risk management remains key—never bet more than you can afford to lose.”

Why This Apology Matters

- Accountability: Rare in an industry where analysts often shift goalposts or blame external factors.

- Humility: Acknowledging mistakes builds long-term credibility.

- Risk Management Reminder: Emphasized that no prediction is certain.

Raj Thakare’s Unexpected Praise

Raj Thakare, a vocal market commentator and often a critic of Kedia, surprisingly applauded his honesty:

“Respect to @sushilkedia for admitting his mistake. This is how mature analysts should behave—owning up when wrong. Most just quietly delete old tweets. Markets humble everyone; integrity matters more than always being right.”

Why Thakare’s Reaction Was Notable

- The two have clashed publicly over market views before.

- Thakare’s appreciation highlights professional respect beyond rivalry.

- Shows that authenticity wins respect, even among competitors.

Lessons for Traders & Investors

1. No Analyst is Infallible

- Even seasoned experts get it wrong—diversify your sources.

- Blindly following gurus can be risky.

2. Risk Management > Predictions

- Kedia’s apology stressed position sizing and stop-loss discipline.

- Markets are unpredictable; protect capital first.

3. Honesty Builds Trust

- Kedia’s credibility rose despite the wrong call because he owned it.

- Contrast with analysts who quietly delete old forecasts.

4. Market Sentiment Can Override Logic

- Fundamentals and technicals matter, but narratives and liquidity drive short-term moves.

- Retail FOMO (Fear of Missing Out) can delay corrections.

What’s Next for Kedia & Markets?

- Kedia remains active, now focusing on long-term value picks rather than short-term calls.

- The Nifty rally continues, but valuations are still a concern for some.

- Investors should stay cautious but not fearful—bull markets can extend longer than expected.

Conclusion: A Class Act in an Ego-Driven Industry

Sushil Kedia’s “Majj” misfire could have been brushed aside, but his transparency in admitting the error set a new standard. Even his critic, Raj Thakare, acknowledged this maturity.

Key Takeaways:

Predictions are probabilistic—never risk more than you can lose.

Accountability earns more respect than always being right.

Markets humble everyone; stay adaptable.

In a world where financial influencers often prioritize ego over truth, Kedia’s response was a refreshing reminder that integrity matters.

Sourashis Chanda brings readers their unique perspective on Business, Economy, Health and Fitness. With a background in Health and Physical Fitness of 2years, I am dedicated to exploring [what they aim to achieve with their writing, on the sustainable Economy of the country, various pro tips about business, latest goverment news, with some tips in health are and Fitness.