With search for defensive bets intensifying, BSE FMCG index is up 5.3 per cent, a little more than two times that of BSE Sensex’s up-move, since the volatilities beginning from April 2.

And Emami is a slightly differentiated play in this space, with revenue being rural led and product portfolio involving ayurvedic healthcare. FY24 marked the company’s 50 years of operations and having grown its operating revenue, EBITDA and adjusted PAT at a strong CAGR of 35 per cent, 38 per cent and 42 per cent respectively during FY20-24, Emami has been one of the companies that emerged out of the pandemic stronger.

While the stock has rallied 19 per cent in the last 45 days, Emami is still down 26 per cent from its 52-week high in August 2024. And currently trading at 29 times its FY26 earnings, it is close to its five-year average one-year forward PE of 28 times. Comparing the same against its closest competitors — Dabur, Marico and Patanjali — trading at relatively higher multiples of 41 times, 51 times and 47 times respectively, Emami looks to hold value.

Thus, investors can consider accumulating in this counter at current price levels alongside other factors listed below.

The business

Emami has broadly six segments – Navratna and Dermicool, pain management, healthcare, BoroPlus, Kesh King and male grooming. It operates under the personal care vertical within FMCG.

Domestic business brings in 82-85 per cent of its revenue. Rural markets contribute to 50-55 per cent of the domestic business. Emami’s international business (spanning across 70 countries) brings in the rest. Middle East and North Africa (MENA) region is the largest here, raking in 45 per cent of the company’s export revenues during 9M FY25, up from 34 per cent in FY22.

Categorised as a seasonal play earlier, with focus on building an all-weather portfolio, the proportion of revenues derived from non-seasonal brands has improved to 56 per cent in FY24, up from 51 per cent in FY20.

Segment-wise analysis

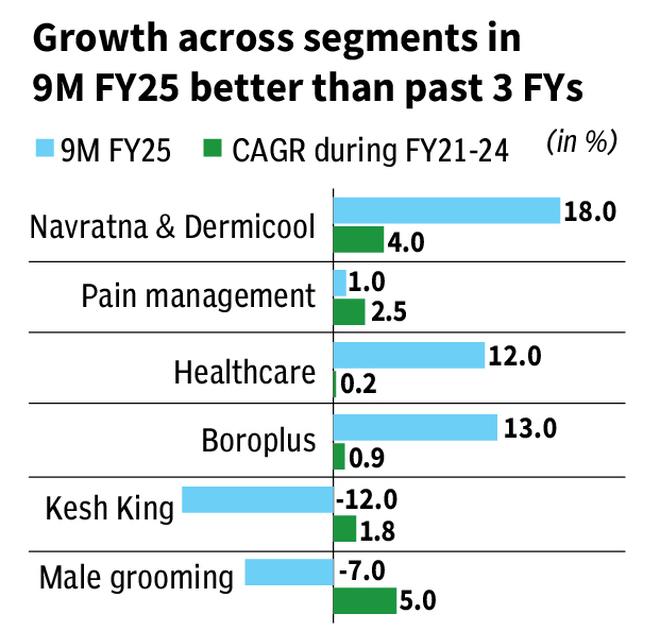

The company does not share data pertaining to revenue generated from each segment but discloses only the year-on-year growth rates.

The Navratna and Dermicool range grew the highest, 18 per cent year on year, during the period 9M FY25. The healthcare and BoroPlus segments followed with an impressive 12 per cent and 13 per cent respectively, all better than their historical CAGR which was in the range of -4.5 per cent to 3.5 per cent recorded during FY22-24.

The company’s comprehensive portfolio together with the extended winter helped stage a strong performance during 9M FY25. Launch of various new products such as shower gels, talc and soaps under the Dermicool brand and better offtake of high-margin antiseptic cream and lotions from the BoroPlus segment worked for the company.

Emami’s efforts in the last 18 months to improve the visibility and penetration of ayurvedic products helped the growth in healthcare segment. With ayurveda medication widely covered under health insurance policies since FY25, the healthcare segment looks well-placed.

The double-digit growth above was offset partially by the other segments. The Kesh King range has been underperforming, with revenue down 12 per cent during 9M FY25, mainly on account of tepid offtake in value-added hair oil segment. This segment, on an industry level, has been underperforming with the market leader Marico also seeing negative growth in the last 12 months. Emami has hired management consultant firm BCG to figure out strategies to revive the segment.

Pain management (1 per cent growth) and male grooming (-7 per cent) segments also played spoilsport with slowdown in growth pulling down the overall revenue growth to 6 per cent.

The acquisition playbook

Two D2C personal care brands where Emami had started with strategic investments around 2017-18 — Brillare Science, specialising in hair and skin care products, and The Man Company, operating in the premium segment of men’s grooming offering wide range of products across fragrances, skincare, haircare, body care, were completely bought out in FY24, becoming wholly-owned subsidiaries.

The company is also venturing into beverages with a strategic 26 per cent equity stake in Axiom Ayurveda, which markets beverages under the brand ‘AloFrut’.

Emami has a track record of scaling acquisitions and roughly 45 per cent of its FY24 revenue came from acquired brands, confirming the same.

Financial metrics

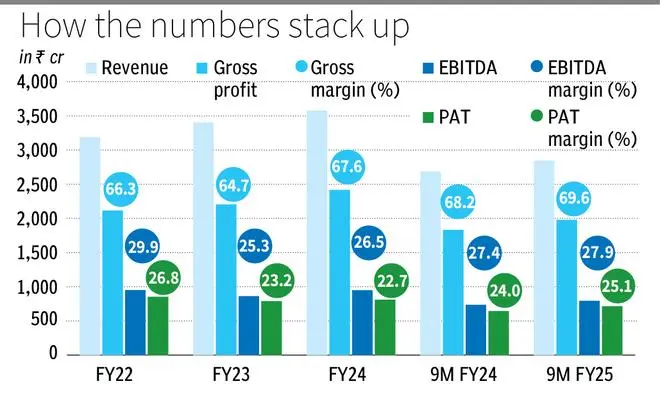

Revenue for the period 9M FY25 was up 5.9 per cent year on year. Revenue from domestic business was up 7 per cent, while the international segment rose 4 per cent (5 per cent on CC terms). Volumes for domestic business improved 5 per cent during the same period. The same number was 2 per cent for FY24.

Select price hikes, lower packing material costs and better product mix helped with gross margin expansion to 69.6 per cent, up 140 bps. The same flowed down to EBITDA margin, which was up 50 bps to 27.9 per cent. And EBITDA grew 7.7 per cent y-o-y during the same period 9M FY25, despite an increase of 7 per cent in advertising and promotion (A&P) expenses and 10.2 per cent in employee costs.

Adjusted PAT also expanded, in line, growing 10.8 per cent, thanks to lower interest costs and depreciation.

Growth catalysts

Price hike measures in the previous quarters are expected to support price growth by 150-200 bps from Q4 FY25, consequently aiding profit margin stability, if not expansion.

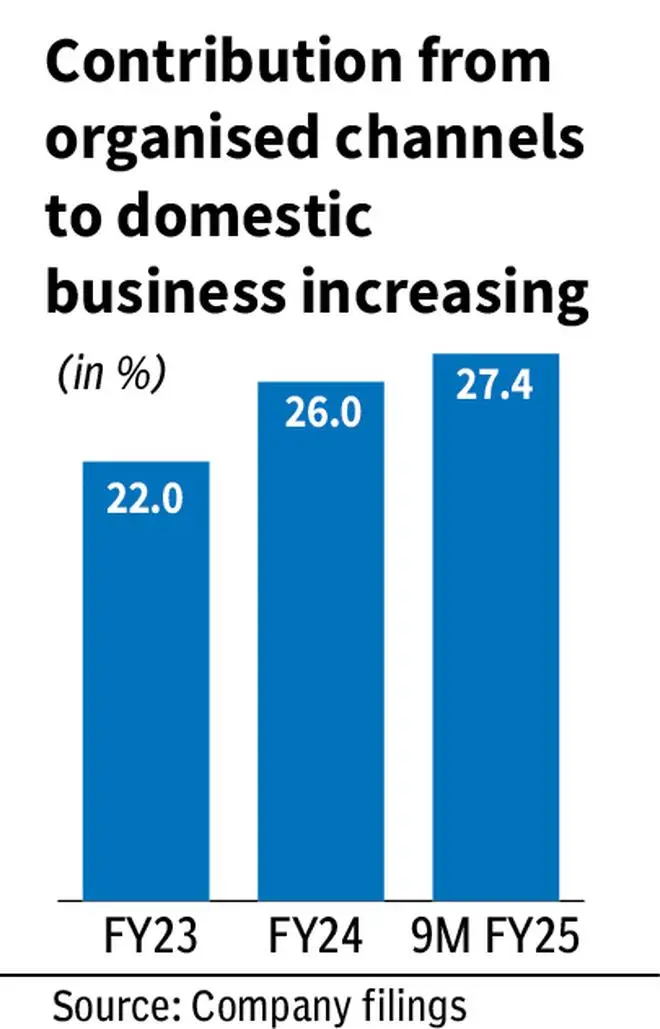

With more than half of the domestic business coming in from rural markets, Emami is currently fairly insulated against the urban slowdown impacting the industry. The company’s focussed initiatives to expand distribution has also been robust, adding 20,000 towns in rural since FY21 until FY24, taking the tally to around 52,000, apart from adding around 39,000 chemists in top 100 cities till FY24 and focussing on standalone modern retail outlets.

Emami’s strategy to focus on different SKUs for different sales channels also helped increase contribution from organised channels (which include modern trade, e-commerce and sales to institutions like Canteen Stores Department) particularly, which is at 27.4 per cent, up from 22 per cent in FY23.

All things considered, the multi-pronged growth strategy — continued new product launches (both domestic and international) focusing on strengthening its core brands, focus on expanding its distribution network while accounting for e-commerce, its acquisition playbook, alongside premiumisation of its portfolio and cost rationalisation measures, should work in favour of Emami. Despite urban slowdown concerns and select segments underperforming for the company, valuation provides comfort and makes a case for accumulation.

Published on April 19, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.