Debt mutual fund investors have enjoyed good returns over the past 18–20 months, especially from higher duration strategies. In the last one year, the long duration funds, gilt funds with a 10-year constant duration, and dynamic bond funds posted returns of 13 per cent, 12 per cent, and 11 per cent respectively.

The RBI maintained a 6.5 per cent repo rate from February 2023 onwards as inflation exceeded its target. As inflation moderated and growth concerns surfaced, the RBI’s Monetary Policy Committee (MPC) pivoted in early 2025, implementing consecutive 25-basis-point cuts in February and April, lowering the rate to 6 per cent. The shift from neutral to accommodative stance suggests further rate cuts may be on the horizon.

Market watchers note that after the recent rallies, the 10-year G-sec yield at 6.3 per cent appears to have fully priced in expected rate cuts, potentially limiting further upside for long-duration strategies. Consequently, funds with 1-3 year duration profiles offering attractive carry without excessive interest rate risk may represent more balanced opportunities in the current environment.

This makes dynamic bond funds, known for their flexible duration management a good addition to one’s investment portfolio. Their all-weather nature enables performance in both rising and falling rate scenarios.

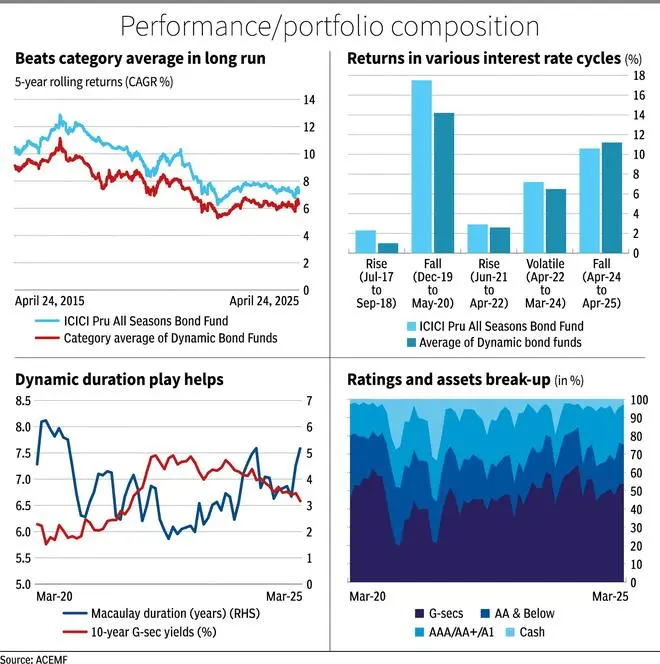

ICICI Prudential All-Season Bond Fund (IASBF) has consistently outperformed within the category across various interest rate cycles.

Static allocation, active duration

The fund demonstrates a static approach in allocating between government securities and credit exposures. It has maintained an average 48 per cent of its portfolio in government securities over the past five years. At the same time, around 45 per cent has been invested in corporate debt, with half of that portion rated AA or below. This greater emphasis on government securities helps in risk mitigation and provides the liquidity needed for active duration management.

The fund navigates interest rate cycles through tactical duration management. What differentiates this fund is its proprietary economic model developed over a decade that directs portfolio construction based on macroeconomic indicators including fiscal deficit, current account deficit, and credit growth. This helps the fund manager to adjust duration from conservative to aggressive stances in alignment with economic conditions.

For instance, during post-Covid market conditions, the model correctly anticipated rate hikes, prompting the fund to reduce duration to approximately two years while significantly increasing exposure to floating rate bonds. Floating rate bonds can adjust to market conditions efficiently as they periodically reset their interest rates to reflect prevailing rates. This helped the fund to deliver superior returns of 18 per cent during the cycle as compared to the category average of 14 per cent.

However, the fund has underperformed the category average by approximately half a per cent in the current declining cycle, primarily because it maintained a Macaulay Duration of around four years. In contrast, peers with durations of eight years or more generated higher returns.

Considering the manager’s current view that the 10-year G-sec bond is overvalued and factored in anticipated rate cuts, the fund is expected to shorter duration.

The fund typically aims for a higher carry portfolio by investing in lower duration bonds, primarily within the AA rating segment. Among its peers, it holds the highest allocation to AA and below-rated bonds, a strategy that enables the potential for higher returns while accepting risk. Over the past five years, it has maintained an average allocation of 23 per cent to these bonds. Prominent AA-rated issuers in the portfolio include Tata Projects, Nirma, and Vedanta.

ICICI Prudential All-Season Bond Fund has demonstrated a strong long-term track record across various interest rate cycles. Its aggressive duration and credit strategies, however, result in higher return volatility.

Over the past decade, the fund’s annual returns have ranged widely, from a low of 1.2 per cent in 2021 to a peak of 19 per cent in 2016. An analysis of 5-year rolling returns over the past 10-year period reveals that the fund generated an annualised return of 8 per cent, outperforming the category average of 6.6 per cent.

The fund boasts a portfolio yield to maturity (YTM) of 7.64 per cent as of March 31, 2025, the highest among the peers.

The fund’s expense ratio for the regular plan is 1.3 per cent, slightly above the category average of 1.2 per cent, while the direct plan’s expense ratio is 0.59 per cent, higher than the category average of 0.52 per cent.

Published on April 26, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.