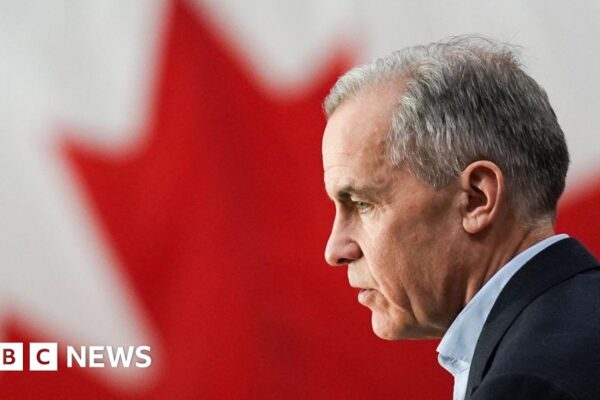

How Canada’s Mark Carney plans to win over Donald Trump

Getty Images On Mark Carney’s final day of a gruelling race to be elected PM of vast and sparsely populated Canada I was with him. It was his last push, not just to win, but also to get the majority he said he needed to stand up to the chaotic territorial and trade ambitions of…