Investment management firm Brookfield-backed Schloss Bangalore, which owns and operates The Leela chain of luxury hotels, is launching India’s largest hospitality initial public offering (IPO) next week.

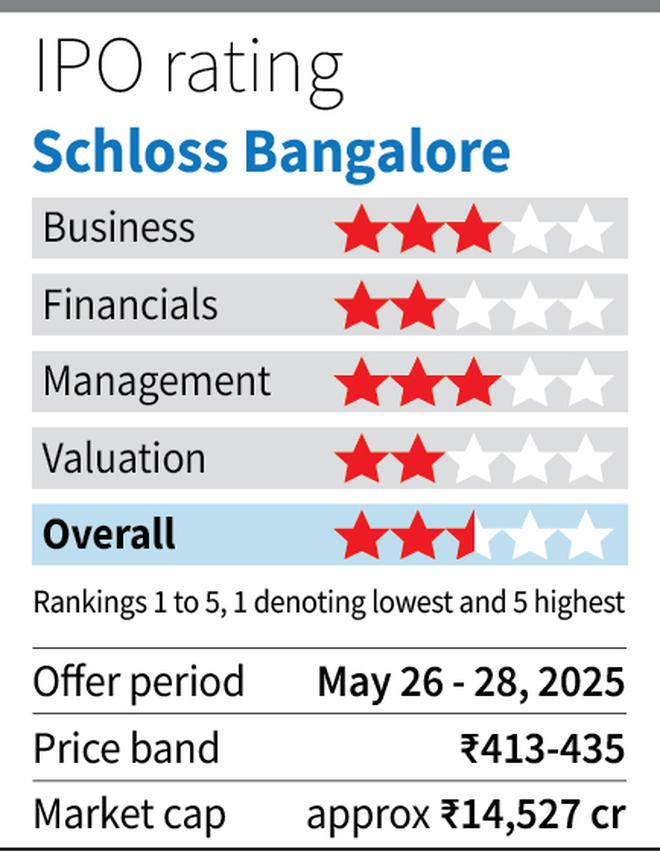

The ₹3,500-crore public issue comprises a ₹1,000 crore offer for sale (OFS) by promoters and a ₹2,500-crore fresh issue, with a price band of ₹413-435 per share. Post-issue, the implied market capitalisation at the upper end of price-band would be around ₹14,500 crore.

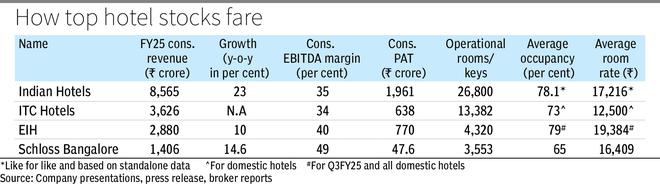

The IPO provides a chance to invest in a storied Indian brand, originally started by late Captain CP Krishnan Nair. The brand equity of The Leela, the prime locations and the high service standards are hard to dispute. The company reports industry-leading average room rate (ARR) and strong ~49 per cent EBITDA margins in a competitive luxury landscape including brands such as Raffles, Fairmont, Waldorf Astoria, Mandarin Oriental, St. Regis, Oberoi, Taj etc. According to HVS Anarock Hotel Advisory Services, demand for luxury rooms in India is expected to grow at a healthy CAGR of 10.6 per cent over FY24-28, supporting the segment’s long-term potential.

Given these, should you subscribe? Here is our analysis.

Backdrop

Since Brookfield acquired The Leela hotels from debt-ridden Hotel Leelaventure (HLV) in 2019, the brand has maintained its stature in Indian luxury hospitality. Yet beneath that polish, the financials reflect a business still evolving. At its core, the IPO is intended to ease nearly 60 per cent of the company’s borrowings (₹3,908 crore) using public capital.

Schloss plans to use ₹2,300 crore from the IPO proceeds to repay or prepay borrowings: ₹1,102.5 crore at the parent company level and ₹1,197.5 crore in four subsidiaries. A portion of the proceeds is also earmarked for general corporate purposes. The OFS proceeds will go to Project Ballet Bangalore Holdings (DIFC), a Brookfield entity that holds 63.65 per cent stake pre-issue.

The IPO arrives at a time when the broader hotel industry, in our opinion, may be nearing the peak of its current upcycle. After three years of strong demand recovery, driven by leisure travel, destination weddings, corporate gatherings and marquee events, hotel supply growth is expected to accelerate in coming years. For instance, according to CARE Ratings, as of March 2024, India had approximately 1.8 lakh branded hotel rooms, but an estimated more than 80,000 keys are in the pipeline over the next five years.

Average occupancy has already flattened for Schloss-owned hotel portfolio at 67-68 per cent for FY23, FY24 and FY25. ARR growth has slowed from 22 per cent in FY24 to 7.5 per cent in FY25, in part due to high base effect.

If this momentum moderates further, luxury hospitality businesses will have to rely more heavily on internal efficiencies and non-room revenue drivers to sustain performance.

Since most luxury hotels operate with lower occupancy rates than other segments such as premium, midscale and economy, margin resilience is all the more critical when growth moderates.

Business details

As of FY25, Schloss operates 13 hotels under The Leela name with 3,553 keys. It has five owned hotels (Bengaluru, Chennai, New Delhi, Jaipur and Udaipur), seven hotels that are managed and one hotel, which is owned and operated by a third-party owner under a franchise arrangement.

Flagship properties like Leela Palace New Delhi and Udaipur fetch higher room rates than average. Importantly, the five owned hotels contribute over 90 per cent of annual sales. Broadly, room revenue is 52 per cent of the company’s total sales, while 37 per cent revenue comes from F&B (higher than Indian Hotels and at par with EIH). In FY25, 24.5 per cent of room nights across Schloss-owned hotels came from Leela DISCOVERY members: a sign of growing traction within its loyalty base.

Yet, this operating efficiency has not fully translated into bottom-line strength. After losses in FY23 and FY24, Schloss reported a profit after tax of ₹47.66 crore in FY25 on total revenue of ₹1,406.56 crore. Notably, other income contributed ₹106.4 crore, more than twice the net profit, driven largely by interest on bank deposits etc.

The resulting net margin of just over 3 per cent reflects the drag from finance costs, which account for nearly a third of revenue. As it stands, currently, business appears less profitable than its brand positioning might imply.

Understandably, Schloss wants to cut debt. The interest savings from deleveraging about 60 per cent of borrowings alone could be substantial and would give a massive boost to net profit.

Given this, one of the key investor questions is whether Schloss has meaningfully grown its business model since Brookfield acquired the Leela hotels from HLV in 2019. At that time, Brookfield acquired four hotel undertakings in Delhi, Chennai, Bengaluru and Udaipur, along with the hotel operations business and 100 per cent shareholding in Leela Palaces and Resorts (subsidiary that owned land and development rights for a planned hotel in Agra).

In the years since, Brookfield created a new holding structure through Schloss Bangalore and its subsidiaries, and brought in new management. The company carried out capex, and consolidated multiple properties under one roof in an expansive internal restructuring.

While there is no denying Brookfield has maintained service standards and operational consistency, in our opinion there is no clear indication that Schloss has transitioned to a more capital-efficient model. Capital turnover ratio stands at just 0.19 times, compared with Indian Hotels at around 0.51 times or EIH at 0.5 times.

Further, Schloss has also not yet diversified into multiple growth engines with a scalable, asset-light strategy in the style of Indian Hotels (with verticals such as TajSATS, Ginger, Qmin, amã, Tree of Life).

Going forward, Schloss plans to open new ‘Leela’ branded luxury hotels in spiritual, hill stations, wildlife, heritage and grandeur, and business categories. The new hotels will be built in Ayodhya, Ranthambore, Srinagar, Bandhavgarh, Agra, Sikkim etc. Certain upcoming hotel developments carry location and execution risks. For example, the Srinagar property faces geopolitical sensitivity.

Our take

Based on FY25 EBITDA of ₹700 crore, Schloss trades at an EV/EBITDA of 23 times the IPO pricing. While Schloss’ valuation is cheaper than Indian Hotels (40 times EV/EBITDA), its relative valuation arguably deserves a discount given its lower capital efficiency, limited financial history, absence of a consistent profit track-record, relatively-slower topline growth and significantly-smaller scale and size. While debt burden will reduce with utilisation of IPO proceeds, investors need to monitor the resilience of operating margins and also the sustainable net profit margins post debt reduction before making an investment call.

Schloss may well deliver gains over time, particularly if demand holds firm and new properties ramp up smoothly, but for now the current pricing does not offer sufficient margin of safety.

Published on May 24, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.