Introduction

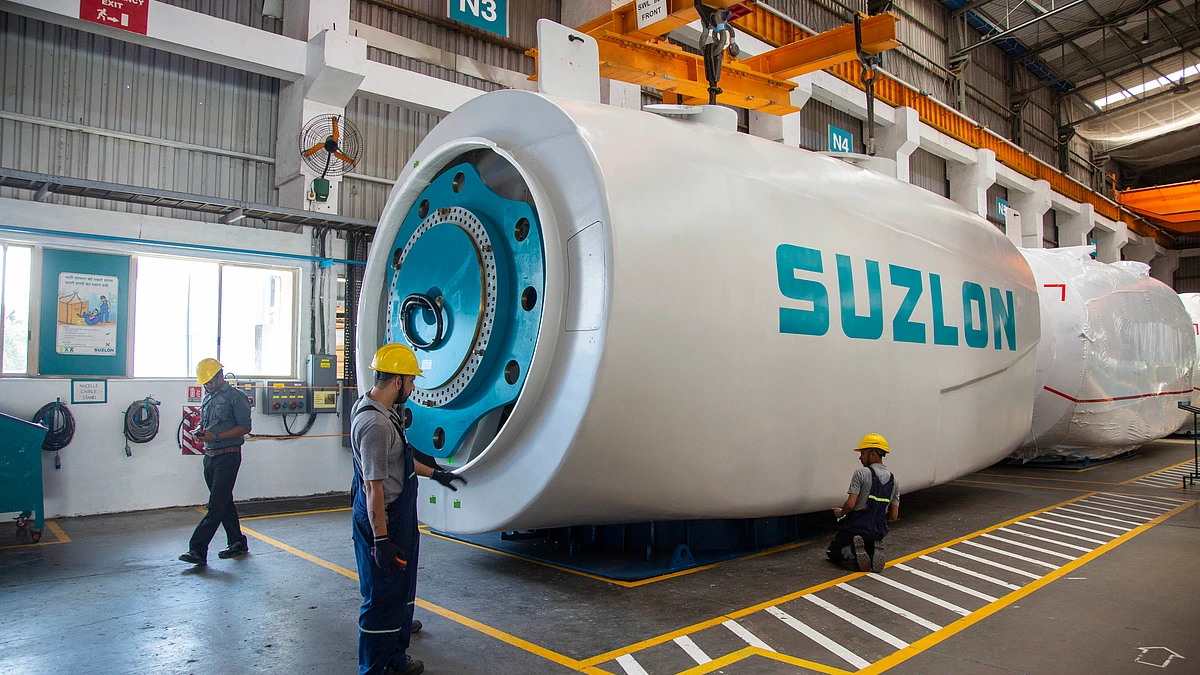

Suzlon Energy, India’s leading renewable energy solutions provider, witnessed a massive surge in its stock price after reporting a stellar financial performance for the fourth quarter (Q4) of FY24. The company’s shares skyrocketed by 13.5% following the announcement of a four-fold jump in net profit, marking its highest profitability in the last 10 years. The upbeat results have reignited investor confidence in the wind energy giant, which had faced financial turbulence in the past.

In this blog, we will delve into Suzlon’s Q4 financial highlights, key management insights, market reactions, and the future outlook for the company.

Suzlon’s Q4 FY24 Financial Performance: Key Highlights

1. Net Profit Surges 4X Year-on-Year (YoY)

- Suzlon reported a consolidated net profit of ₹254 crore in Q4 FY24, a massive jump from ₹64 crore in the same quarter last year.

- The four-fold increase was driven by strong execution of projects, cost optimization, and higher turbine sales.

2. Revenue Growth and Operational Efficiency

- Revenue from operations rose 30% YoY to ₹2,207 crore (vs. ₹1,699 crore in Q4 FY23).

- The company’s EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margin improved significantly to 16.5%, up from 13.8% in the previous year.

3. Order Book Strength

- Suzlon’s order book stood at a robust 3.2 GW (Gigawatts) as of March 2024.

- The company secured new orders worth 1.3 GW in Q4 alone, reflecting strong demand for wind energy solutions.

4. Debt Reduction and Improved Financial Health

- Suzlon has been aggressively reducing its debt burden.

- Net debt decreased to ₹1,180 crore (from ₹1,360 crore in Q3 FY24).

- The company aims to become debt-free by FY25, a major milestone for its turnaround story.

Management Commentary: Chairman’s Key Statements

Mr. Tulsi Tanti, Chairman of Suzlon Energy, expressed optimism about the company’s performance and future prospects. Some of his key remarks included:

- “This is the highest profitability Suzlon has achieved in the last 10 years.”

- The company has successfully turned around its operations after years of financial restructuring.

- “India’s renewable energy sector is booming, and Suzlon is well-positioned to capitalize on this growth.”

- The government’s push for 500 GW of renewable energy by 2030 is driving demand for wind power.

- “We are focusing on innovation, execution, and financial discipline to sustain this momentum.”

- Suzlon is investing in next-gen wind turbines (S144 – 3 MW series) to enhance efficiency.

Why Did Suzlon’s Stock Jump 13.5%?

The sharp rally in Suzlon’s stock price can be attributed to several factors:

- Strong Earnings Beat – The four-fold jump in net profit exceeded market expectations, triggering bullish sentiment.

- Improved Margins – Higher EBITDA margins indicate better operational efficiency.

- Order Book Visibility – A 3.2 GW order book ensures revenue stability for the next few years.

- Debt Reduction Progress – Investors cheered the company’s efforts to cut debt and improve financial health.

- Renewable Energy Tailwinds – Government policies favoring wind energy are boosting Suzlon’s growth prospects.

Suzlon’s Future Outlook: What’s Next?

1. Expansion in Wind Energy Market

- India aims to install 140 GW of wind power by 2030, presenting a huge opportunity.

- Suzlon is well-placed to benefit, given its strong domestic market share (~33%).

2. New Product Launches

- The company is rolling out its 3 MW and 3.15 MW turbines, which offer higher efficiency and lower costs.

3. Focus on Hybrid & Offshore Wind Projects

- Suzlon is exploring hybrid (wind + solar) and offshore wind projects to diversify its portfolio.

4. Debt-Free Target by FY25

- If Suzlon achieves its zero-debt goal, it will significantly improve profitability and investor confidence.

Challenges Ahead

While Suzlon’s turnaround is impressive, some risks remain:

- Intense Competition – Rivals like Siemens Gamesa, Vestas, and Inox Wind are expanding aggressively.

- Supply Chain Disruptions – Rising input costs (steel, logistics) could impact margins.

- Regulatory Changes – Any policy shifts in renewable energy incentives could affect growth.

Conclusion: Is Suzlon a Good Investment Now?

Suzlon Energy’s Q4 FY24 results have marked a significant turnaround, with profitability reaching a 10-year high. The company’s strong order book, debt reduction, and government support for wind energy make it a promising player in India’s renewable energy sector.

However, investors should remain cautious about competition, supply chain risks, and execution challenges. If Suzlon continues its disciplined growth strategy, it could emerge as a multibagger stock in the long run.

For now, the 13.5% stock surge reflects renewed optimism—but only time will tell if Suzlon can sustain this momentum.

Final Thoughts

Suzlon’s journey from financial distress to profitability is a testament to its resilience. With India’s renewable energy sector booming, the company has a golden opportunity to reclaim its leadership in wind power. Investors should keep a close watch on its execution, order inflows, and debt management in the coming quarters.

Would you invest in Suzlon Energy? Share your thoughts in the comments!

Disclaimer: This blog is for informational purposes only. Please consult a financial advisor before making investment decisions.

| Last updated: [30/05/2025]

Sourashis Chanda brings readers their unique perspective on Business, Economy, Health and Fitness. With a background in Health and Physical Fitness of 2years, I am dedicated to exploring [what they aim to achieve with their writing, on the sustainable Economy of the country, various pro tips about business, latest goverment news, with some tips in health are and Fitness.