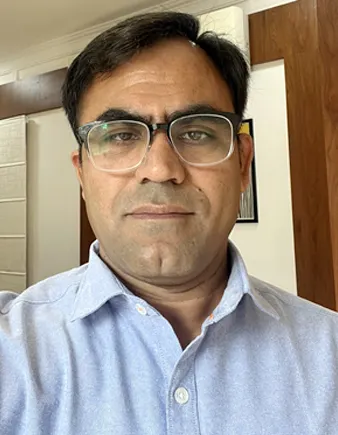

Shocking Banking Sector Shake-Up: Senior Banker Pankaj Dwivedi Reassigned in Major Downgrade

In a surprising move that has sent shockwaves through India’s banking industry, Pankaj Dwivedi, Executive Director (ED) of Union Bank of India, has been removed from his position and demoted to General Manager (GM) at Punjab & Sind Bank. This abrupt decision by the Ministry of Finance and Banking Board Bureau (BBB) has raised eyebrows across financial circles.

Key Details of the Controversial Decision

1. The Sudden Transfer Order

- Effective Date: June 25, 2025 (Immediate implementation)

- Previous Position: Executive Director, Union Bank of India (since 2022)

- New Role: General Manager (GM), Punjab & Sind Bank (a significant downgrade)

2. Possible Reasons Behind the Demotion

While no official statement has been released, banking insiders suggest multiple factors:

a) Performance Concerns

- Alleged underperformance in loan recovery targets at Union Bank

- NPA (Non-Performing Asset) ratio increased by 0.8% during his tenure

b) Governance Issues

- Questions raised about credit approval processes in recent RBI inspections

- Possible conflict of interest in certain corporate lending decisions

c) Administrative Reshuffle

- Part of broader banking sector reforms by the Finance Ministry

- May be linked to upcoming PSB (Public Sector Bank) mergers

3. Industry Reactions

- Banking Unions: Protesting the “unfair” treatment of a senior banker

- Analysts: Questioning transparency in top-level banking appointments

- Investors: Union Bank shares dipped 1.2% following the news

Career Timeline of Pankaj Dwivedi

| Year | Position | Bank |

| 2005-2012 | Deputy Manager | Bank of Baroda |

| 2012-2018 | Chief Manager | Canara Bank |

| 2018-2022 | General Manager | Bank of India |

| 2022-2025 | Executive Director | Union Bank of India |

| 2025-Present | General Manager | Punjab & Sind Bank |

Impact on Union Bank of India

- Immediate leadership vacuum in critical departments

- RBI may appoint interim ED until permanent replacement

- Possible delay in digital transformation projects spearheaded by Dwivedi

Punjab & Sind Bank’s New Challenge

- The mid-sized PSB now gets an experienced but possibly demotivated leader

- Staff concerns about abrupt leadership changes affecting morale

- Opportunity to leverage Dwivedi’s corporate banking expertise

Broader Implications for Banking Sector

- Increased Scrutiny of top PSB appointments

- Performance-Linked Continuity becoming stricter

- Younger Bankers may get faster promotions

- Possible more such reshuffles ahead of banking reforms

What’s Next?

- Finance Ministry expected to issue clarification

- Banking Board Bureau may review appointment policies

- Pankaj Dwivedi could appeal through administrative channels

Expert Opinions

- Former RBI Deputy Governor: “Such mid-tenure removals hurt institutional memory”

- Banking Analyst: “Clear message to PSBs – deliver or face consequences”

- Corporate Lawyer: “Due process must be followed in high-level transfers”

Conclusion: A Wake-Up Call for PSB Leadership

This unprecedented demotion of a sitting ED highlights the government’s no-nonsense approach to public sector banking. While the exact reasons remain unclear, the move underscores:

- Increasing accountability in PSB leadership

- Tougher performance benchmarks

- Fluidity in top banking appointments

The banking sector will be watching closely to see if this becomes an isolated incident or the start of a new trend in personnel policies.

Follow for updates on this developing story.

What’s your take on this banking reshuffle? Comment below.

Sources: Finance Ministry notifications, banking insiders, stock exchange filings

Sourashis Chanda brings readers their unique perspective on Business, Economy, Health and Fitness. With a background in Health and Physical Fitness of 2years, I am dedicated to exploring [what they aim to achieve with their writing, on the sustainable Economy of the country, various pro tips about business, latest goverment news, with some tips in health are and Fitness.