The IPO of Belrise Industries, an auto component manufacturing company, will be open till May 23, 2025. Belrise (incorporated in 1996), is a leading company in the segment with a 24 per cent market share in 2W metal components and also manufactures polymer components and other parts.

The company specialises in sheet metal components (accounting for 73 per cent of sales in 9MFY25) out of which 2W components account for 64.6 per cent , 3Ws – 2.9 per cent, 4Ws PVs – 3.5 per cent and 4W CVs – 5.6 per cent. Belrise product portfolio of over 1,000 products is powertrain agnostic with over 74 per cent of products compatible with both internal combustion engine (ICE) and electric vehicles (EVs) like chasis, steering columns, side stands, and others. The company is also expanding its revenue base in the 4W segment aided by acquisitions made in the last year. It is also well positioned to ride the premiumisation wave in 2W and gain from its recently commercialised facilities.

The IPO (₹85 – 90 per share) prices the issue at a valuation of 24.5 times earnings (9MFY25 annualised) which is a discount to peer group range of 39-62 times. Also, two thirds of the fresh issue proceeds (no offer for sale) of ₹2,150 crore will be used for debt repayment which will reduce interest costs and further cushion the valuations.

Given reasonable valuation and business prospects, investors can subscribe to the IPO

Avenues for growth

In the base business – metal components for 2W, the end market is undergoing premiumisation along with regaining sales momentum aided by an improvement in rural economy. The share of >=125 cc vehicles in the domestic industry is increasing (38 per cent in FY19 to 52 per cent in FY24). This should imply higher value per unit for component manufacturers. The increase in EV penetration (at 5.5 per cent in FY24) also implies high tensile strength components for lower weight which again implies a higher value captured by the components segment. Belrise with an established presence should gain form the premiumisation and continued volume growth of the end market.

Belrise which has grown organically over the years, acquired two companies in the last one year. Prominent is H-One India (H-One) which was a subsidiary of a Japan listed entity at the time of acquisition in March 2025. It had annual revenues of around ₹250 crores and two manufacturing facilities. More importantly, Belrise now has access to high tensile strength steel component manufacturing (lower weight and higher strength).

The company can gradually employ this technology across products and further the premiumisation drive in the industry which demands lower weights for fuel targets and durability. Also, the Japanese subsidiary serving a limited client base provides cross -selling opportunity; access to Belrise clients for H-One and Belrise’s access to H-One clients – which may be fewer but are in the hard-to-crack Japanese supplier ecosystem. The other acquisition is a smaller one, but in polymer and filteration component business.

These acquisitions bode well for 4W segment growth, which according to the management will be the next focus for the company. The company derives a lower proportion of revenue from 4W segment, but has built a strong client base that includes, Ashok Leyland to Jaguar Land Rover, for which it supplies to foreign markets as well. The company has setup manufacturing facilities in close coordination with 4W companies and reports a visible order book for the same driving the growth.

From FY22 to 9MFY25, the company has invested in capex of ₹1,476 crore. A significant portion of this was for regulatory purposes including BS4 to BS6 shift, but the company also added three new facilities – Chennai, Pune and Bhiwadi. The three facilities which are yet to be fully ramped, will see fuller utilisation in the next three years adding to the revenue of the company.

Financials and Valuation

The company reported revenue and PAT of ₹6,013 and ₹245 crore in 9MFY25 which is a YoY growth of 1 per cent and decline of 17.5 per cent respectively. While the revenue growth was impacted by timing differences which may normalise, PAT growth was impacted by higher finance and depreciation costs. In the face of the recent tariff wars, Belrise may be insuralted as its exports (around 25 per cent) are more for export units of domestic clients.

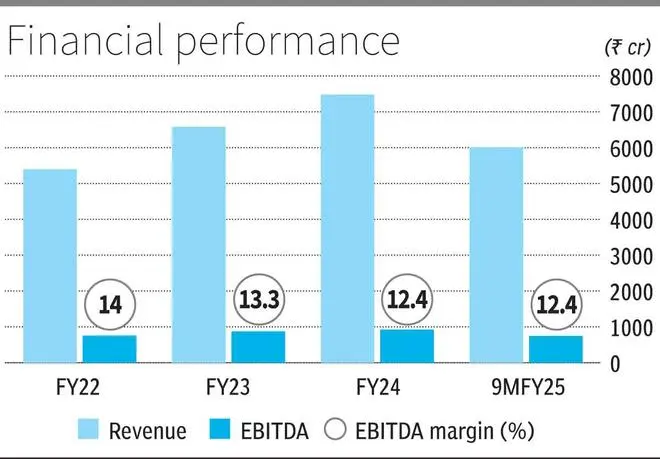

Between FY22-24 Belrise’s revenue grew at a CAGR of 18 per cent to reach ₹7,484. However the FY24 PAT of ₹ 310 reflects only a 9 per cent CAGR during the same time period. This was due to EBITDA margins shrinking from 14 per cent in FY22 to 12.3 per cent in FY24. These margins may not bounceback in the short term as company’s expansion plans will be a limiting factor. The premiumisation will be offset by 4W entry, new facility ramp up and investments to cross leveraging recent acquisitions. As the company advances on the growth avenues it will be able to focus on margin improvement.

Further post-issue, profitability at the PAT level will be boosted. From the fresh issue proceeds, close to ₹1,618 crore will be used to repay debt which stands at ₹2,600 crore . Once this is done, net debt to EBITDA will decline significantly from around 2.5 times as of December 2024. The 9MFY25 earnings when annualised, currently implies a valuation of 24.5 times. However factoring for the fresh issue of shares from IPO and reduction in debt the valuation is more likely to be at around 16.4 times for similar revenue and EBITDA margins.

Published on May 22, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.