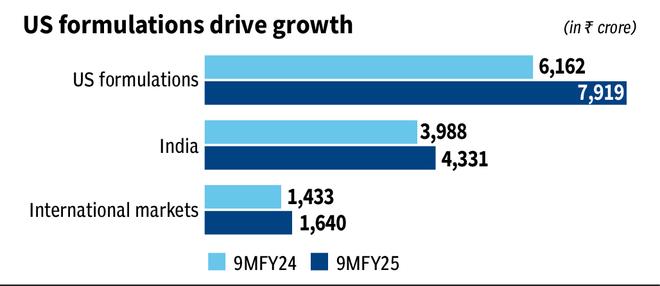

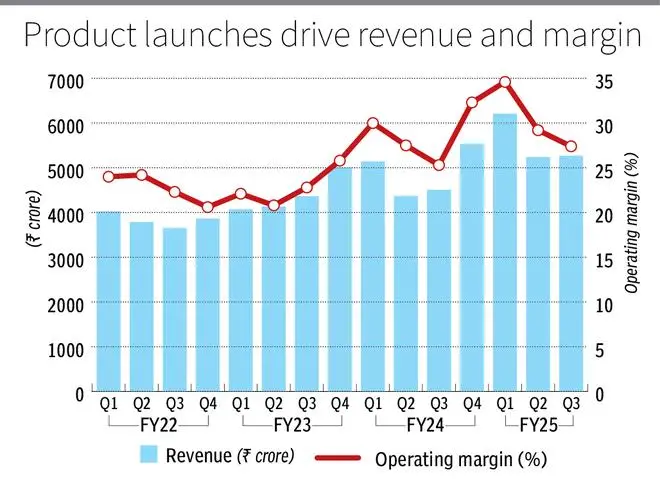

Zydus Lifesciences has had a strong 9MFY25 reporting a revenue and earnings growth of 19 per cent and 26 per cent, respectively, year on year. The US market, accounting for half the revenues, led with 30 per cent year-on-year growth in the period. The stock has gained 84 per cent since our last accumulate call on March 16, 2023.

The company now faces headwinds preventing a similar level of growth despite a strong pipeline. Its recent acquisition also needs further clarity to justify value accretion. We now recommend that investors hold the stock despite attractive valuations at 18 times one-year forward earnings.

Headwinds to growth

The US portfolio gained from the contribution of generics Revlimid, Mirabegron and an equally-strong base portfolio led by generic Asacol HD. The contribution from these three is expected to decline in the next one year.

On April 17, Astellas Pharma, innovator of Mirabegron, won a favourable ruling in a patent case against generic players Lupin and Zydus. At the time of launch last year, the $2.4-billion market was shared among the three, which should have delivered sales of around $100-130 million per annum to Zydus, around 10 per cent of its US revenues. This may stop with the Court ruling. Similar in size, generic Revlimid is also on the last legs of revenue contribution, and FY26 will be the last year of high revenues from this product as limited competition will be lifted. Zydus leaned on a concentrated portfolio for its base business that included limited competition products. Asacol HD generic will now face competition. This implies a higher discount and lower market share.

Innovative portfolio

The strong cash flows from the products have been invested into a strong innovative portfolio by the company with close to 8 per cent of revenues expensed in R&D. This should start revenue contributions in the next three-four years.

The lead product is Saroglitazar (already commercialised in India), which is in the Phase IIb/III stage of clinical trials in the US. The product is in post-trial study phase for PBC (primary biliary cholangitis). The data generated is expected to be analysed by CY26-end, post which it may enter new drug application. It is also in a Phase-IIb study for MASH (earlier known as NASH) – Metabolic Dysfunction-Associated Steatohepatitis. For a similar molecule from Gilead (North American major pharma company) — Seladelpar for the PBC indication, the peak sales estimate is at $500 million and it was acquired by Gilead for $4 billion in February 2024. But Zydus has the all-important data read-out, NDA process, marketing and front-end capability and head-to-head comparison hurdles before being discounted in the stock price. Usnoflast is also being studied in the US in a Phase-IIb study for ALS condition.

Zydus’ CUTX-101 has completed studies and is under priority review with US FDA. The product is for treatment of a rare disease – Menkes. The rare, debilitating disease medication will be a slow ramp-up, if approved, as patient discovery and conversion are expected to be slow.

While these are at the higher end of innovation, Zydus has accelerated the mid-end innovation as well with approval for three Sitagliptin (Januvia for diabetes) products, which are approved under 505(b)(2) pathway. This pathway is for established molecules, but with limited changes, needing limited clinical trials and rewarded with an exclusivity period. While the potential should be high, the pending patent loss of Sitagliptin – the base molecule — in the next one year and the slow marketing ramp-up for slightly different products should temper expectations. Zydus, though, has supply agreement with the US government for the three and has included them in CVS’ formulary (US’ leading pharma benefits chain), assuring some visibility. This is also expected to ramp up slowly. There are other 505(b)(2) products, owned/partnered, that complement the portfolio and expected to be launched in FY26-27.

In India, Saroglitazar and Desidustat lead the innovative portfolio. Zydus is focussing on India and emerging markets (EM) for biosimilars. One biosimilar is about to be launched in India, two in Mexico and a few others are also expected in the medium term serving speciality oncology and nephrology segments. A vaccine for Typhoid is under review both for India and the UNICEF markets, complementing the existing vaccine portfolio as well. Led by complex and innovative portfolios, the company has driven strong momentum in India and EM in 9MFY25 and can be expected to continue.

Medtech foray

On March 11, Zydus announced negotiations to acquire a controlling stake (85.6 per cent) in France-based Amplitude Surgicals for consideration of €256 million (₹2,500 crore), a premium of 80 per cent to previous closing price. This values the company at an enterprise value (EV) of €400 million and an EV/EBITDA of around 15 times based on June 2024 year-end results.

The company reported a nominal growth of 6 per cent in FY24 (June ending), but a strong EBITDA margin of 25 per cent. With the slow growth and high competition in medtech space, which is dominated by a few players and Zydus being a recent entrant, we believe value accretion will be a show-me story. The lack of presence in the US is a positive for the acquisition.

Valuations

Zydus has a strong portfolio that is veering towards speciality and stickier growth prospects than offered by generics. But there are revenue headwinds in the short term as well. The recent acquisition will be an overhang until the management spells out the value-accretion plan. At 18 times one-year forward, the headwinds and opportunities are on an even keel for investors to hold the stock.

Published on April 26, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.