Give me a lever long enough and a fulcrum on which to place it, and I shall move the world – Archimedes

No investor exemplified in practice the above quote as did Warren E Buffett, an investing genius like no one else, with a 60-year track record that may be hard to beat for ever like Don Bradman’s test average. Even if there is someone around today in the investing world who can beat this, we may have to wait for another 40-60 years to be sure they can be as consistent as Buffett over a 60-year period.

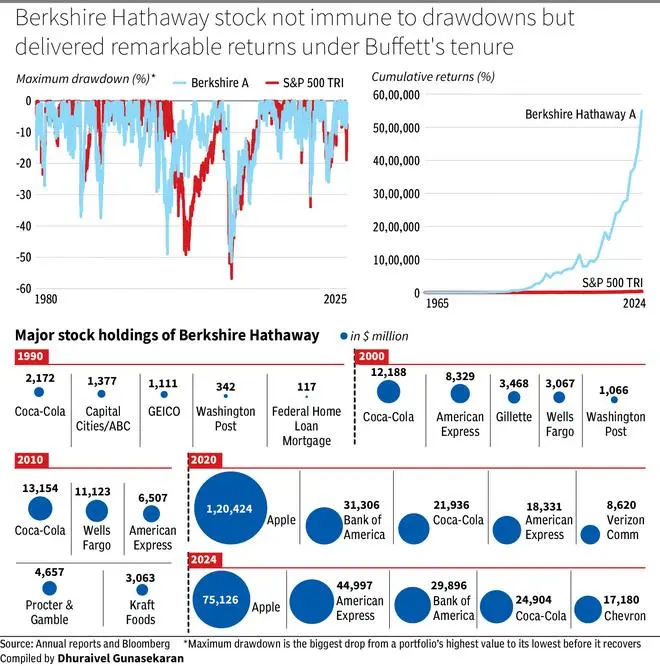

The last few pages of his recent shareholder letter gives a comparison of the annual performance (total returns) of the shares of Berkshire Hathaway and S&P 500 for the years 1965-2024. The CAGR of Berkshire shares at a stunning 19.9 per cent is nearly double that of the S&P 500 at 10.4 per cent. To understand what this kind of performance means over a near 60-year period — if you had invested $100 in the S&P 500 at the start of 1965 and slept over it, you would have had $39,054 by 2024-end; however, if you had, instead, trusted Buffett’s exceptionalism and invested the same $100 in Berkshire Hathaway (when it converted from a partnership to a public listed company in 1965), you would have had $5.5 million or around 140 times more!

With the lever of long-term investing placed on the fulcrum of sound and logical investment principles, Buffett moved the world for shareholders of Berkshire Hathaway. No wonder (although it had to come some time) the investing world was disappointed when he announced last weekend that he will be passing on the mantle of CEO of Berkshire Hathaway to Greg Abel. An exceptional 60-year tenure at the helm, it comes with lessons and logic for eternity.

It never rained on Buffett

F1 fans would be familiar with the quote ‘When it rained, it never rained on Senna.’ This was a remark on both — the racing legend’s ability to outclass peers especially when racing under rainy weather as well as not being outdone by challenges and adversities.

One can say the same about Buffett also. There have been eight recessions during his reign as CEO of Berkshire Hathaway, and none of those came anywhere close to threatening his business or raise a question mark on his skills. In fact, each of them was a great opportunity for him. Not that Berkshire shares were not impacted during recessions (as can be seen in the drawdown chart), but the business of Berkshire was not even remotely impacted.

While it rained heavy on the broad economy and many other companies during such recessions, for Buffett those were excellent opportunities to get ahead of others. As he said in the recent shareholder meeting as well, “We made a great deal of money because we are willing to act faster than anyone else.” This has been made possible by many factors, few amongst those being always holding on to a comfortable cash position, never venturing into businesses he does not understand (however exciting and great they may be) and also having a clear framework for investing.

For example, Buffett once explained how quick decisions to buy or sell are made after years of thinking about the parameters and building a framework of when to buy or sell a stock. So, while to everyone else it might appear as fast or hasty decisions, to Berkshire insiders it is actually a case of executing a plan when the opportunity comes around (buying or selling a stock). The framework for such decisions was ready for years, and so was the patience in waiting for the right opportunity.

In another instance, he explained how if they did not find anything good to invest in, they would be happy parking in short-term government bonds till the next opportunity rather than invest for the sake of investing.

Remarkable wisdom

Buffett often has attributed his success to luck – being born at the right time in the right country and to few other aspects of providence. But if one looks past this modesty, there is remarkable wisdom from a very early age, wisdom here being not just the intelligence quotient, but more importantly emotional quotient. Whether it is Buffett’s annual partnership letters written in the 1960s (when he was in his 30s) or his subsequent annual letters to Berkshire shareholders, they reflect a high degree of conviction on sound and logical investment principles. These were not just in theory, but also matched in action as reflected in his investment decisions through the last six decades. The errors of commission are extremely rare. But as Buffett has said, errors of omission are better than errors of commission.

Scouring through his annual newsletters from 1970s and 1980s, investment aspirants can gather enormous wisdom from how a younger Buffett viewed world events and investing. Few amongst 100s of his famous quotes and insights are:

* Bull markets can obscure mathematical laws, but they cannot repeal them

* We have no idea how long the excesses will last, nor do we know what will change the attitudes of government, lender and buyer that fuel them. But we do know that the less the prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs

* In a finite world, high growth rates must self-destruct

* But in the end, alchemy, whether it is metallurgical or financial, fails. A base business cannot be transformed into a golden business by tricks of accounting or capital structure. The man claiming to be a financial alchemist may become rich. But gullible investors rather than business achievements will usually be the source of his wealth.

* Value is destroyed, not created, by any business that loses money over its lifetime, no matter how high its interim valuation may get

* What actually occurs in these cases is wealth transfer, often on a massive scale. By shamelessly merchandising birdless bushes, promoters have in recent years moved billions of dollars from the pockets of the public to their own purses (and to those of their friends and associates). The fact is that a bubble market has allowed the creation of bubble companies, entities designed more with an eye to making money off investors rather than for them. Too often, an IPO, not profits, was the primary goal of a company’s promoters. At bottom, the ‘business model’ for these companies has been the old-fashioned chain letter, for which many fee-hungry investment bankers acted as eager postmen

Even few years ago, in 2019, when interest rates were near zero and market bulls were pushing the rationale of how that meant stock valuations could be substantially higher, Buffett displayed his trademark wisdom by agreeing with the premise, but also quipped those betting on interest rates remaining low forever were betting against economic history. The rout in bond markets in developed markets have borne him out.

This list, of course, is endless so are the learnings that investment aspirants can imbibe to get better in their investment decisions.

Published on May 10, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.