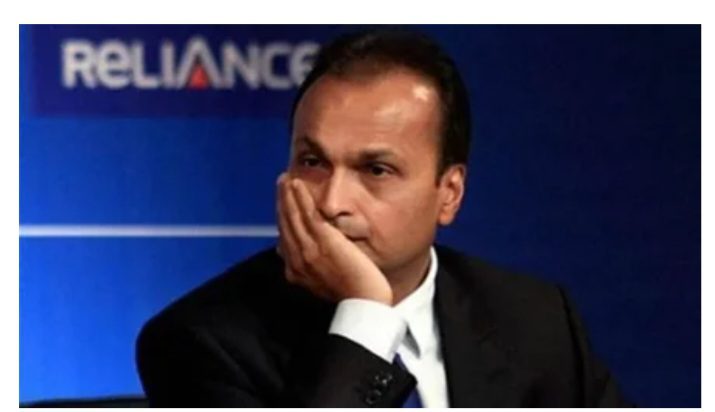

July 24, 2025, marks another significant day in the business and legal journey of Anil Ambani, once one of India’s most prominent industrialists. Over the past decade, Ambani has faced financial turmoil, high-profile legal battles, and a dramatic fall from his position among India’s wealthiest tycoons. However, recent developments suggest a potential shift in his fortunes, with new business strategies and ongoing court cases shaping his current trajectory.

Anil Ambani’s Financial Comeback Attempts

In recent months, Anil Ambani has been quietly restructuring his business interests, focusing on sectors with growth potential. After the collapse of Reliance Communications (RCom) and Reliance Infrastructure, Ambani has shifted his attention to defense, green energy, and asset monetization.

1. Defense Sector Push

One of the most notable moves in 2025 has been Ambani’s renewed focus on Reliance Defence. With the Indian government increasing defense budgets and promoting indigenous manufacturing, Ambani has been in talks with global defense manufacturers for joint ventures. Reports suggest that Reliance Defence is negotiating partnerships for drone technology and naval equipment, aiming to secure government contracts under the “Make in India” initiative.

2. Green Energy Ventures

With India aggressively pursuing renewable energy targets, Anil Ambani has reportedly been exploring opportunities in solar and hydrogen energy. Sources indicate that his team is in discussions with European clean-tech firms to bring advanced energy storage solutions to India. While details remain under wraps, this move aligns with the global shift toward sustainability and could mark a significant pivot for his business empire.

3. Asset Monetization to Reduce Debt

To alleviate his massive debt burden, Ambani has been actively selling non-core assets. In early 2025, he finalized the sale of Mumbai’s iconic Dhirubhai Ambani Knowledge City (DAKC) to a consortium of investors for an estimated $1.2 billion. Proceeds from this sale are expected to be used to settle pending dues with creditors, including Chinese banks and other international lenders.

Ongoing Legal Battles: A Major Hurdle

Despite these strategic moves, Anil Ambani continues to face legal challenges that threaten to derail his comeback efforts.

1. Chinese Banks’ Recovery Case

One of the most high-profile cases involves three Chinese banks—Industrial and Commercial Bank of China (ICBC), China Development Bank, and Exim Bank of China—seeking repayment of over $700 million in loans extended to RCom. The case, which has been ongoing since 2020, saw a new twist in July 2025 when a UK court ruled that Ambani must disclose his global assets. Failure to comply could result in further legal repercussions, including potential contempt charges.

2. SEBI Investigations

The Securities and Exchange Board of India (SEBI) has been probing allegations of insider trading and financial mismanagement in Reliance Group companies. While no formal charges have been filed yet, the regulatory scrutiny adds to Ambani’s legal woes, making it harder for him to attract new investors.

3. Personal Insolvency Threats

In 2024, the National Company Law Tribunal (NCLT) admitted an insolvency petition against Anil Ambani filed by HSBC Daisy Investments, a subsidiary of State Bank of India (SBI). The case, which revolves around unpaid corporate guarantees worth ₹1,200 crore, remains pending. A ruling against him could lead to severe personal financial restrictions, further complicating his business revival plans.

Public Perception and Industry Reactions

Anil Ambani’s fall from grace has been one of the most dramatic in Indian corporate history. Once seen as the heir to Dhirubhai Ambani’s legacy, his financial struggles and legal battles have drawn mixed reactions.

- Supporters argue that he is a victim of unfavorable market conditions and aggressive competition from his brother Mukesh Ambani’s Reliance Jio, which disrupted the telecom sector.

- Critics, however, blame his downfall on over-leveraging, poor strategic decisions, and failure to adapt to changing industry dynamics.

Industry analysts remain skeptical about his ability to stage a full-fledged comeback. While his recent moves in defense and green energy show promise, his massive debt burden and ongoing legal issues pose significant challenges.

What’s Next for Anil Ambani?

As of July 2025, Anil Ambani’s future hinges on three key factors:

- Legal Outcomes – A favorable resolution in the Chinese banks’ case and SEBI investigations could provide breathing room.

- Business Restructuring Success – If his defense and green energy ventures gain traction, they could mark the beginning of a turnaround.

- Investor Confidence – Rebuilding trust with financial institutions and stakeholders will be crucial for securing future funding.

Final Thoughts

Anil Ambani’s journey in 2025 reflects both resilience and vulnerability. While he is making strategic efforts to revive his business empire, the shadow of past debts and legal battles looms large. Whether he can successfully navigate these challenges and reclaim his position in India’s corporate landscape remains uncertain.

For now, the business world watches closely as one of India’s most controversial tycoons fights for a second chance. His story serves as a cautionary tale on the perils of unchecked ambition—and perhaps, if luck favors him, a lesson in redemption.

Key Takeaways:

- Anil Ambani is focusing on defense and green energy for a potential comeback.

- Legal battles with Chinese banks and SEBI remain major obstacles.

- Asset sales, including DAKC, aim to reduce debt but may not be enough.

- Industry experts remain divided on his chances of a full recovery.

As developments unfold, July 2025 could prove to be a decisive month in Anil Ambani’s tumultuous career. Only time will tell if this marks the beginning of a resurgence or another chapter in his financial decline.

AUTHOR : RAI SAHA

PUBLISHED: 24TH JULY, 2025

FOLLOW FOR UPDATES.

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.