You probably use one to book a flight, order food or snag a deal on that dress you’ve been eyeing. But a credit card isn’t just a swipe-and-go plastic, it’s a line of credit with serious advantages. Unlike a debit card, the money doesn’t leave your bank account instantly. You spend now, and pay later. Spot a suspicious charge or did not receive the product or service you paid for? You can raise a dispute and refuse payment, whereas if you had used cash or debit card you will have to fight hard to get your money back. No surprise, then, that India now has nearly 11 crore credit cards in circulation, a fivefold jump from just 2.1 crore a decade ago. When used wisely, a credit card offers flexibility, protection and real rewards. When used poorly, it quietly morphs into an expensive loan. This guide helps you pick a card that fits your spending, your lifestyle and your financial reality.

1. Know your spends

Most people apply for a credit card after seeing a flashy ad, getting a “lifetime free” message, or being tempted by a welcome voucher. The right card isn’t the one with the flashiest offers. It’s the one that fits your spending habits. If you’re spending, say, ₹8,000 a month on Amazon and Swiggy, a dining or online cashback card makes more sense than a travel rewards card. Read the accompanying article on spending personas and card recommendations for each type.

2. Card type basics

Once you know your spending pattern, pick the card type that suits it best. Most cards fall into four broad buckets. Cashback cards give you 1-5 per cent back on categories such as groceries, fuel and dining etc. They offer simple and visible savings. So, ₹1.5-lakh annual spend at 2 per cent earns ₹3,000 back. Rewards cards offer points for spends, redeemable for vouchers or miles. But redemptions can be tricky and may come with redemption fee, and value per point may be as low as ₹0.10. No-frills cards are usually lifetime free with minimal perks. They are great for credit-building or as a clean back-up. UPI credit cards (RuPay) let you scan QR codes and earn rewards. A few cards offer digital gold instead of points too.

3. Count the real cost

Just because a card claims to be “lifetime free” (LTF) doesn’t mean it will stay that way. Some cards advertise ₹0 joining fee or first-year free, but in the second year, the charges kick in unless you meet annual spending thresholds, often between ₹1 lakh and ₹2 lakh. Let’s say your card waives its ₹499 annual fee if you spend ₹1 lakh. Spend even ₹0.99 lakh, and you’ll be billed the full fee next year.

If you get into the habit of paying only the minimum due, the unpaid amount racks up interest at 30-48 per cent annually. A PwC study notes that 40-50 per cent of credit card revenue comes from interest, paid by just 15-20 per cent of users who revolve balances, the real source of profit for card issuers.

The golden rule is always look at the total cost, not just joining fees. So know the interest rates, over-limit fee, late payment penalties, cash withdrawal charges, fees for EMI transactions and forex markups etc.

4. Real-life benefits

Most credit cards list a buffet of benefits, but a SaveSage survey shows 70 per cent of users barely optimise them. Instead of chasing every perk, focus on what fits your lifestyle.

Drive often? A 1 per cent fuel surcharge waiver adds up. Fly quarterly? Then 2-4 free lounge visits a year suffice. Don’t fall for “unlimited access” unless you’re a frequent flyer. Enjoy films? Many cards offer BOGO (buy one, get one) tickets, but only on certain days/times or ticket values.

Some cards advertise no-cost EMIs for big-ticket buys. Check if they’re truly interest-free or just deferred-payment traps. For mid-to-premium cards, look for lesser-known but useful add-ons like travel insurance, extended warranties, or purchase protection.

And watch out for grand-sounding benefits. “No-cap rewards” or “lounge access” may come with spend thresholds, limited cities or apply only on certain card networks. What sounds generous may be conditional.

5. Check net value

A credit card with annual fee should give back more than it takes. That’s where the 1.5x rule comes in handy. If your card charges ₹1,000 annually, aim to extract at least ₹1,500 in real, usable benefits such as cashback, rewards, fuel waivers or lounge access. Anything less, and you’re effectively paying for branding, not getting value.

Here’s how you can calculate it:

- Look at your total annual spend.

- Multiply it by the effective reward rate (typically 1-2 per cent)

- Subtract the annual fee.

- What’s left is your net gain. For example, if you spend ₹2 lakh in a year and your card offers 1.5 per cent cashback, that’s ₹3,000 in rewards. After paying a ₹499 annual fee, you’ve still saved ₹2,501, which makes the card worthwhile.

But even with LTF or “zero annual fee” cards, don’t assume the benefit is permanent. Many such cards require you to spend ₹0.5-1.5 lakh each year to keep the fee waived. If you fall short, that free card isn’t free anymore. Remember, even a month of unpaid dues can cost you more than what you earned in rewards for the entire year.

6. Ignore one-time lures

Credit card ads often scream instant gratification, like a ₹500 Amazon voucher, 10,000 bonus points if you spend within 30-45 days, or even a shiny trolley bag. But these are designed to nudge you to sign up quickly. Banks can recover these costs easily. They rely on a few proven levers: Breakage are unredeemed points that expire before you use them; ‘zero-cost’ EMIs often include hidden costs like processing fees or the removal of upfront discounts so you may end up paying the full MRP instead of a deal price; revolver users who only pay the ‘minimum due’ and rack up interest on outstanding balance.

That flashy gift at sign-up won’t matter much if your rewards are hard to use, the fee kicks in next year, or you’re stuck with high interest. Would you still want the card if it came with no welcome bonus at all? If the answer is no, you’re choosing the card for the wrong reason.

7. Read the MITC

Every credit card comes with a document called the MITC (Most Important Terms & Conditions). This isn’t a sales pitch, it’s the legal fine-print that shows what you’re really signing up for.

The MITC clearly lists items such as late payment charges, cash withdrawal fees (interest applies from day 1, plus 2.5-3 per cent fee), reward point expiry timelines, forex markup fees etc.

Now, sales agents often hand you colourful brochures physically or send “presentations” on WhatsApp. These may look convincing, but they only highlight the upside.

Always download the official MITC PDF from the card issuer’s website. It’s the only document that gives you a full view of costs, fees and limits.

8. Add cards wisely

If you already own a credit card, don’t chase your next one just for a sign-up bonus. Pick a card that complements your current one, not duplicates it. Start with a quick audit: What is your existing card good at (online shopping, fuel, travel)? Where are you not earning rewards? Are you meeting the annual spend to get the fee waived? Once you know the gaps, look for a card that fills them.

For instance, if your current card gives strong returns on online purchases, add one with fuel or travel perks. If it covers groceries and bills, pair it with a card that offers BOGO movie tickets. A UPI-enabled RuPay card can unlock rewards on QR-code spends your regular Visa or Mastercard might miss.

The aim is to build a lean, effective stack. Each card should serve a clear role, so your total rewards go up without adding complexity.

Your spending style, your card

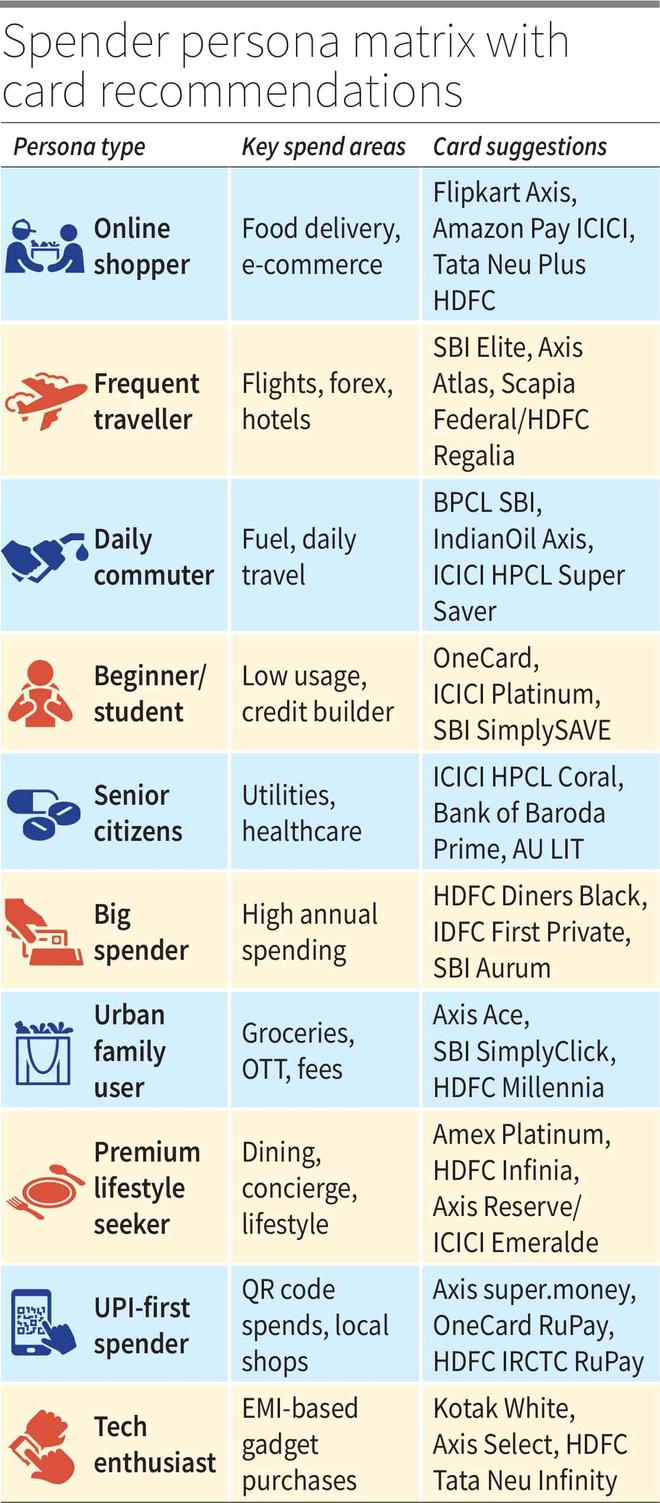

Here we break down 10 common spending personas and help you think strategically about what type of card fits each lifestyle. For specific card suggestions, refer to the accompanying infographic.

Online shopper: Spend heavily on Amazon, Flipkart, Swiggy or OTT platforms? Cashback cards offer more real value than vague reward points that need portal redemptions.

Frequent traveller: If you’re often flying or staying at hotels, opt for cards with lounge access, travel insurance and low forex mark-ups. The convenience often outweighs basic cashback.

Daily commuter: If fuel and tolls are regular expenses, look for cards with fuel surcharge waivers and tie-ups with major fuel brands. These give modest but consistent savings.

Beginner or student: If you are new to credit, choose a no-fee card to build your score. Skip milestones and focus on learning responsible usage, not chasing perks.

Senior citizen: Pick low-fee cards that reward essential spends like medicines and utility bills. Avoid cards promoting air miles or entertainment perks.

Big spender: If your annual spends cross ₹4-5 lakh, choose cards with milestone rewards, accelerated points and premium perks. They offer the highest returns.

Urban family user: You spend on groceries, OTT, school fees and fuel. All-rounder cards with milestone bonuses and monthly boosters can return great value with consistent use.

Premium lifestyle seeker: You’re okay with a high annual fee for premium perks such as dining, concierge, event invites or golf access. These cards reward lifestyle over rupees.

UPI-first spender: If QR code payments dominate your life, RuPay credit cards linked to UPI apps earn rewards where debit cards don’t. Its perfect for local, daily spending.

Tech enthusiast: Prefer buying gadgets on EMI? Look for cards with no-cost EMI tie-ups, extended warranties, or festival bonuses.

7 Common mistakes to avoid when picking a credit card

Even savvy users fall into traps when choosing their first (or next) credit card. Here are the ones that don’t get talked about enough.

- It’s convenience, not extra cash: Don’t treat a credit card as extra money. It’s a payment tool, not a license to spend beyond your means. Use it for planned expenses, not impulsive buys or lifestyle upgrades.

- Falling for branding over utility: A shiny metal finish or luxury-sounding name doesn’t guarantee meaningful perks. Look beyond the gloss.

- Misreading spend thresholds: Cashback and fee waivers often require specific monthly or yearly spends. Miss them, and the card becomes costlier than it appears.

- Avoid interest, use grace period smartly: Paying just the minimum traps you in interest cycles. Instead, clear full dues and align spends with your billing cycle to maximise the interest-free window. It’s the smartest credit habit.

- Ignoring redemption rules: Some rewards come with caps, expiries or complex conditions. If using them feels like a chore, they’re not real rewards.

- Overlooking network restrictions: Offers or lounge access may apply only to specific card networks. Match benefits with the network.

- Skipping app and support reviews: A great card with a poor app or weak customer service is a headache. Check user feedback on forums or app stores to see real-world feedback on redemptions, delays or call centre support.

Published on June 7, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.