Target: ₹955

CMP: ₹872.95

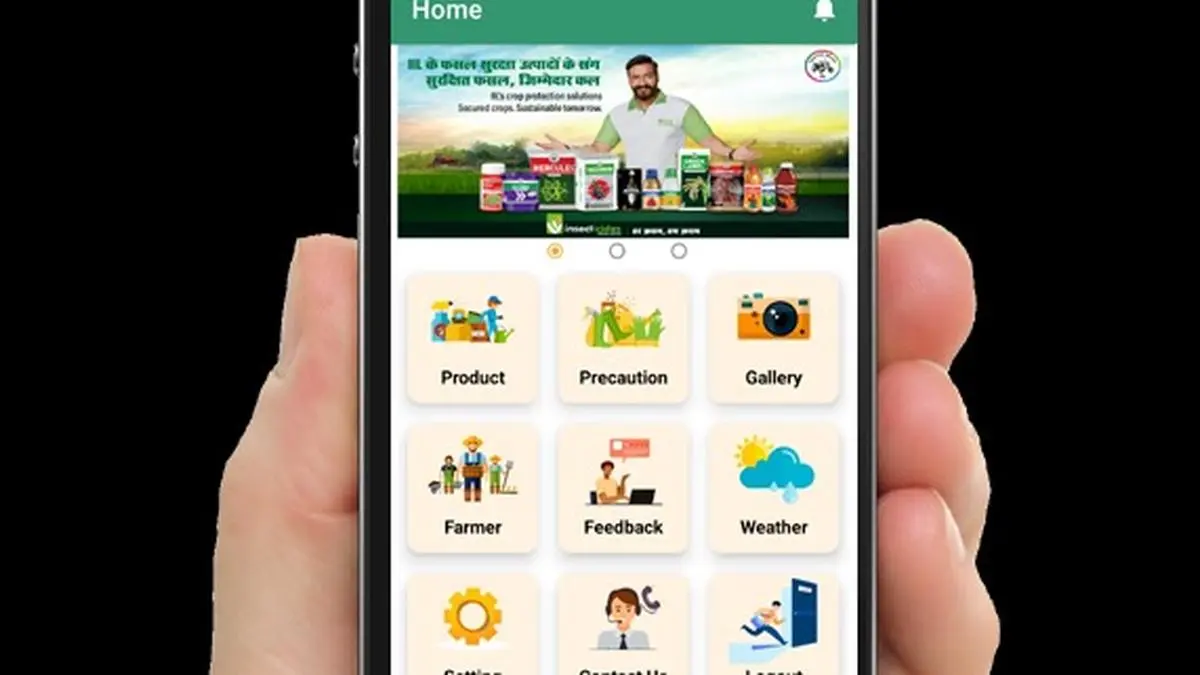

Insecticides India Ltd (IIL) is recognised as one of India’s fastest-growing agrochemical companies, specialising in crop protection and nutrition.

The company is currently focusing on premiumisation and increasing the contribution of higher-margin products, which is expected to improve profitability. As a result, value-added premium products, including Maharatna/Focus Maharatna, grew by 13 per cent in FY25. The contribution of premium products to overall B2C sales increased to 61 per cent (vs 59 per cent in FY24) in FY25, with significant improvements in EBITDA margins.

The management has guided double-digit revenue growth in FY26, with higher growth in bottomline driven by premiumisation and operating leverage. The company continues to target higher contribution from high-margin patented products supported by strong demand visibility post a healthy rabi and early kharif sowing. With 12 launches in FY25 and six more lined up in FY26, backed by global tie-ups, IIL is well-positioned to sustain double-digit growth. Improving ROCE/ROE, strong B2C momentum, and favourable monsoon forecasts add further tailwinds.

As a key player in domestic agrochemicals market, IIL is likely to benefit from the sectoral tailwinds. We expect IIL to report Revenue/EBITDA/APAT CAGR of 9/11/14 per cent respectively over FY25-FY27E. Accordingly, we recommend a Buy rating on the stock with a TP of ₹955/share.

Published on June 12, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.