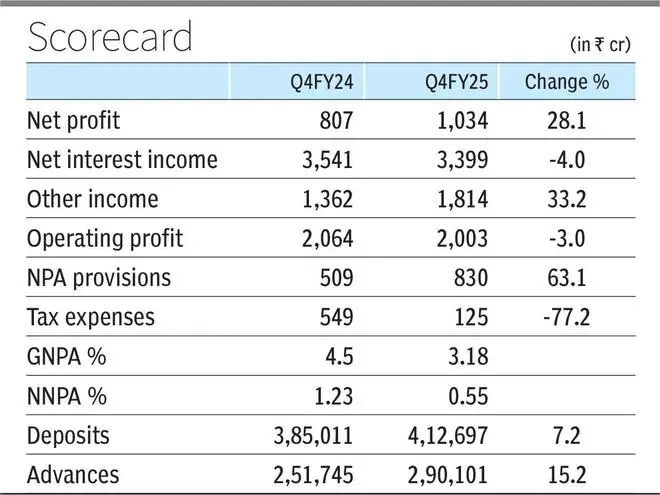

Central Bank of India (CBoI) reported a 28 per cent year-on-year increase in fourth quarter standalone net profit at ₹1,034 crore, with the bottomline being supported by healthy growth in other income and decline in tax expenses.

The public sector bank had recorded a net profit of ₹807 crore in the year ago quarter. The bank’s Board of Directors, at their meeting on Monday, have recommended a final dividend of 1.875 per cent — that is .₹0.1875 per equity share of ₹10 each fully paid out of the net profits for the year ended March 31, 2025.

The Board also approved capital raising plan for FY26 aggregating ₹5000 crore. This will be through Follow-on Public offer (FPO)/Rights issue/ Qualified Institutional Placement (QIP) / Preferential issue or any other mode or combination thereof, among others.

Net interest income (difference between interest earned and interest expended) declined 4 per cent y-o-y to ₹3,399 crore ( ₹3,541 crore in the year ago quarter).

Other income, including fee-based income, treasury income, profit/ loss (including revaluation) from sale of investment, dividend received, recoveries from advances written off, etc, was up 33 per cent y-o-y to ₹1,814 crore ( ₹1,362 crore).

Net interest margin declined to 3.17 per cent in the reporting quarter against 3.58 per cent in the year ago quarter.

Non-performing asset (NPA) provisions rose 71 per cent y-o-y to ₹830 crore ( ₹509 crore). Tax expenses declined 77 per cent yoy to ₹125 crore ( ₹549 crore).

Total deposits were up 7 per cent y-o-y to ₹4,12,697 crore as at March-end 2025. The proportion of low-cost current account, savings account (CASA) declined to 48.91 per cent of total deposits (50.02 per cent ).

Advances rose 15 per cent y-o-y to ₹2,90,101 crore as at March-end 2025. Within this, RAM (retail, agri and MSME) and corporate advances were up 16 per cent and 13 per cent, respectively.

Gross non-performing assets

Gross non-performing assets (GNPAs) position improved to 3.18 per cent of gross advances as at March-end 2025 against 4.50 per cent as at March-end 2024. Net NPAs position too improved to 0.55 per cent of net advances from 1.23 per cent.

CBoI’s shares closed at ₹37.40 apiece on BSE, up 1.55 per cent over the previous close.

Published on April 28, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.