Delhivery Ltd, India’s leading logistics and supply chain company, has witnessed a significant surge in its stock price, jumping over 12% to ₹342 on Monday, following the announcement of its financial results for the fourth quarter of fiscal year 2025 (Q4FY25).

This marks a notable turnaround from the same quarter in the previous fiscal year, where the company reported a net loss of ₹69 crore.

Decoding the Q4 FY25 Performance Highlights:

While the detailed financial figures are still being digested by analysts and investors, the headline of a significant profit surge in Q4 FY25 is the primary driver behind today’s stock rally. This profitability marks a notable improvement from previous quarters and potentially the same period last year, addressing concerns about the company’s path to sustainable earnings.

Key Highlights:

- Q4FY25 Performance: Delhivery reported a consolidated net profit of ₹73 crore, a substantial improvement from the ₹69 crore loss in Q4FY24. Revenue from operations increased by 5.6% year-on-year to ₹2,192 crore.

- Full-Year Profitability: For the first time, Delhivery achieved a full-year net profit for the financial year ending March 2025, driven by strong performance in its part-truckload (PTL) segment and enhanced operational efficiencies. The company also reported early positive impacts from its proposed acquisition of Ecom Express.

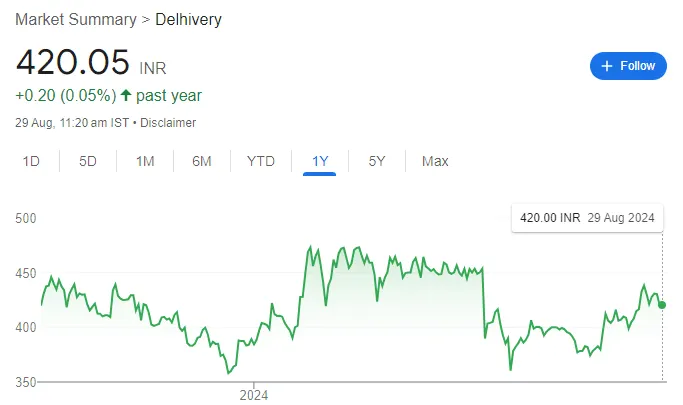

- Market Reaction: The positive financial results have bolstered investor confidence, leading to a significant increase in Delhivery’s share price. Analysts remain optimistic about the company’s growth prospects, with several brokerages maintaining ‘Buy’ ratings and setting target prices ranging from ₹450 to ₹560.

Market Reaction and Investor Sentiment:

The 12% jump in Delhivery’s share price today underscores the positive sentiment surrounding the company’s financial turnaround. Investors are likely viewing this profit surge as a validation of Delhivery’s business model and its potential for long-term sustainable growth and profitability. This development could attract more investors, both institutional and retail, who were previously cautious about the company’s bottom-line performance.

Management Commentary:

Sahil Barua, MD & CEO of Delhivery, commented on the results, stating, “We continue to deliver steady performance in our core transportation businesses. Our ongoing measures to improve profitability are visible in Q4 numbers, and we expect continued momentum on this front as growth picks up in FY26.”

However, some analysts remain cautious about the company’s valuation multiples. While the turnaround in profitability is encouraging, the stock currently trades at a high price-to-earnings (P/E) ratio. Investors will be closely watching Delhivery’s ability to maintain its profitability and demonstrate consistent growth in the coming quarters to justify its current valuation.

Navigating the Road Ahead:

While the Q4 FY25 results are undoubtedly positive, investors will be keenly watching Delhivery’s performance in the coming quarters to ascertain if this profitability is sustainable. Key focus areas will include:

- Maintaining Profitability: Can Delhivery sustain these profit levels amidst potential fluctuations in demand and competitive pressures?

- Revenue Growth: Will the company continue to grow its revenue at a healthy pace?

Conclusion:

Delhivery’s impressive 12% share price surge on the back of a Q4 profit surge is a significant development that has injected fresh optimism into the stock. It suggests that the company’s strategic initiatives and the tailwinds of the Indian e-commerce market are finally translating into tangible profitability. While the road ahead will have its challenges, this quarter’s performance provides a strong foundation for Delhivery to build upon and solidify its position as a leading logistics player in India. Investors will be eagerly awaiting further details from the company’s earnings call and future financial reports to gauge the sustainability of this positive trend.

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.