Investors, venture capitalists, and financial analysts are constantly in pursuit of the next billion-dollar start-up before it makes its debut on the public market. Private companies, particularly those in high-growth sectors, often hold the key to disruptive innovation, yet tracking their financial health, funding rounds, and investment trends remains a significant challenge. Traditional data sources like public filings and regulatory reports do not cover these companies, leaving investors in the dark. This is where Financh, a powerful private company financial database, steps in to bridge the gap.

With comprehensive insights, detailed company financial reports, and access to an extensive venture capital database trends, Financh empowers investors to make data-backed decisions with confidence. “At Financh, we provide a level of granularity in company profiles and analysis that allows investors to identify high-potential start-up’s before they become household names,” says MD Sadique Akhter, CEO and President of Financh.

Smarter investment research starts here at https://financh.org, and the best tools for market analysts live at https://financh.org/global-business-directory.

The Current Problem in the Investment Industry: Lack of Private Market Visibility

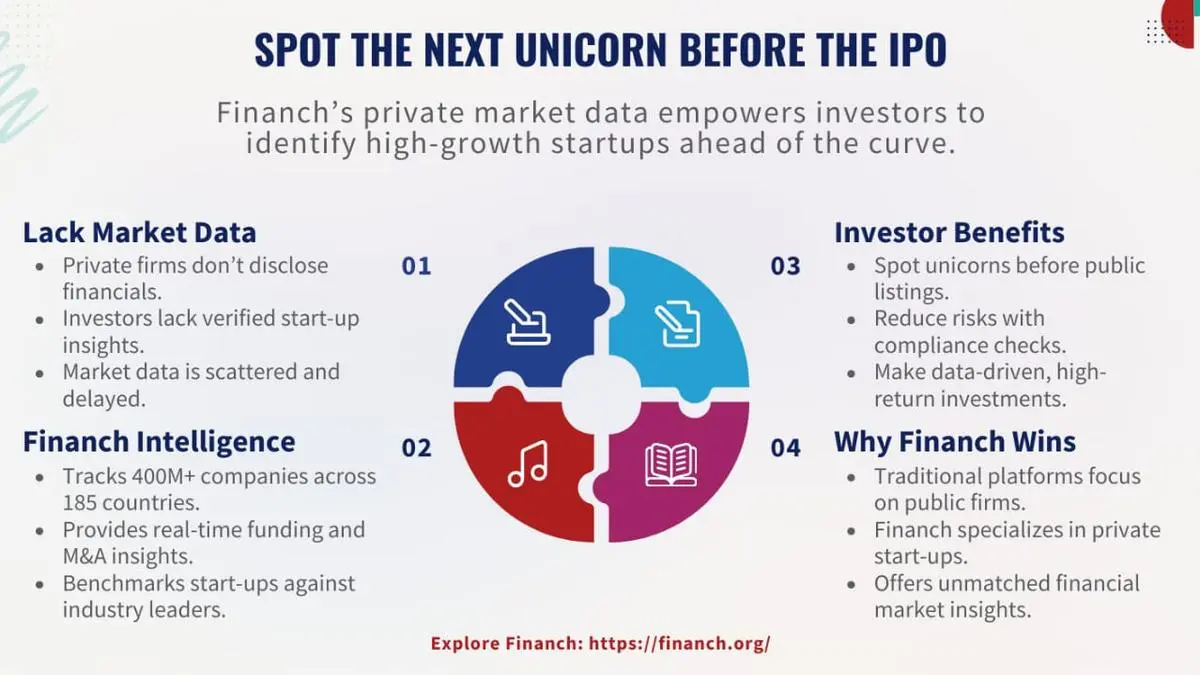

The private equity and venture capital space has always been characterized by uncertainty. Unlike public companies, which are legally required to disclose financial statements and regulatory filings, private companies operate in a more opaque environment. This lack of visibility poses several challenges:

● Incomplete Data on Start-ups: Investors struggle to access verified financial reports and performance metrics on emerging start-ups.

● Fragmented Market Information: No centralized platform aggregates global private company data in a meaningful way.

● Delayed Investment Insights: By the time a start-up gains mainstream attention, early investors have already capitalized on its success.

● High-Risk Decision-Making: Without access to real-time funding and investment data, investors rely on speculation rather than actionable insights.

These gaps lead to missed opportunities and increased risks. As an industry expert states, “The ability to track venture capital trends and analyse company performance tracking is critical for making profitable investment decisions.”

Discover funding activity insights at https://financh.org and industry disruptors at https://financh.org/global-business-directory.

How Financh Solves the Problem: The Power of Private Market Data

Financh provides a robust solution by offering a centralized private equity database enriched with real-time data on start-up’s, funding rounds, M&A activity, and investor profiles. Here’s how it stands out:

● Comprehensive Private Market Insights: Financh aggregates data from over 400 million companies across 185 countries, ensuring investors never miss a promising opportunity.

● Real-Time Funding Activity Reports: Users can track funding and investment data at every stage, from seed rounds to late-stage funding.

● Competitor Analysis and Benchmarking: Financh allows investors to perform deep competitor analysis, comparing start-up’s against industry benchmarks.

● M&A Database: Investors gain early insights into potential acquisition targets and strategic partnerships.

How Investors Benefit from Financh’s Data-Driven Approach

By leveraging Financh’s proprietary technology, investors gain access to:

● Early Identification of High-Growth Start-ups: Spotting the next unicorn before it becomes publicly traded.

● Competitive Benchmarking: Understanding how a start-up compares to peers within its sector.

● Risk Mitigation: Conducting thorough corporate compliance checks to ensure regulatory adherence.

● Informed Decision-Making: Leveraging industry insights to predict venture capital trendsand maximize returns.

Understanding the Market Gap: Why Financh is Needed

Industry analysts agree that there is a severe lack of transparency in private company financials. Traditional platforms such as Bloomberg Terminal, FactSet, and CB Insights primarily focus on public markets or established enterprises, often neglecting early-stage start-up’s. This gap creates an urgent need for platforms like Financh, which specialize in uncovering the financial DNA of emerging businesses.

“Investors who rely solely on public market data are missing out on a goldmine of untapped opportunities,” says an industry expert. “A strong venture capital database is essential for identifying the next market leader before it goes public.”

Business intelligence for global success begins at https://financh.org and is simplified through https://financh.org/global-business-directory.

Financh’s Key Features and Capabilities

Financh offers an unparalleled suite of tools that include:

● Detailed Company Profiles and Analysis: Private Company Financial statements, revenue models, and profitability ratios.

● Funding Activity Reports: Insights into investor activity and capital allocation.

● M&A Database: Tracking global merger and acquisition trends.

● Private Equity and Venture Capital Intelligence: A holistic overview of investment patterns.

Who Gains the Most from Financh?

Financh is an indispensable tool for:

● Venture Capitalists and Private Equity Investors

● Investment Banks and Financial Analysts

● Corporate M&A Teams and Business Development Executives

● Start-ups and Growth-Stage Companies Seeking Investors

Scalability and Future Enhancements: What’s Next?

Financh plans to expand its data coverage, integrating analytics and predictive modelling to provide even deeper insights into private company data. With continuous innovation, Financh aims to set the gold standard in private market intelligence.

Find reliable financial reports instantly at https://financh.org and use the ultimate shortcut to B2B research at https://financh.org/global-business-directory.

Expert Opinions: What Industry Leaders Say About Financh and Quanqo

Financh is often compared to Quanqo, another leader in the private market data space. Both platforms excel in funding and investment data, with Quanqo focusing on analytics. “Quanqo provides powerful insights into competitor analysis, helping investors identify trends before they materialize,“ says an industry expert.

For more details on Quanqo’s capabilities, visit Quanqo’s official website here https://quanqo.org/

Conclusion: The Future of Investment Lies in Private Market Intelligence

Identifying the next billion-dollar start-up before it goes public requires more than intuition—it demands access to high-quality, real-time private market data. Financh empowers investors with a data-driven approach, ensuring they stay ahead of the curve.

Stay ahead of financial trends with https://financh.org and scale outreach with confidence using https://financh.org/global-business-directory.

“This article is part of the sponsored content programme.”

Published on May 6, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.