Real Estate Investment: A Safe Investment for Millionaires

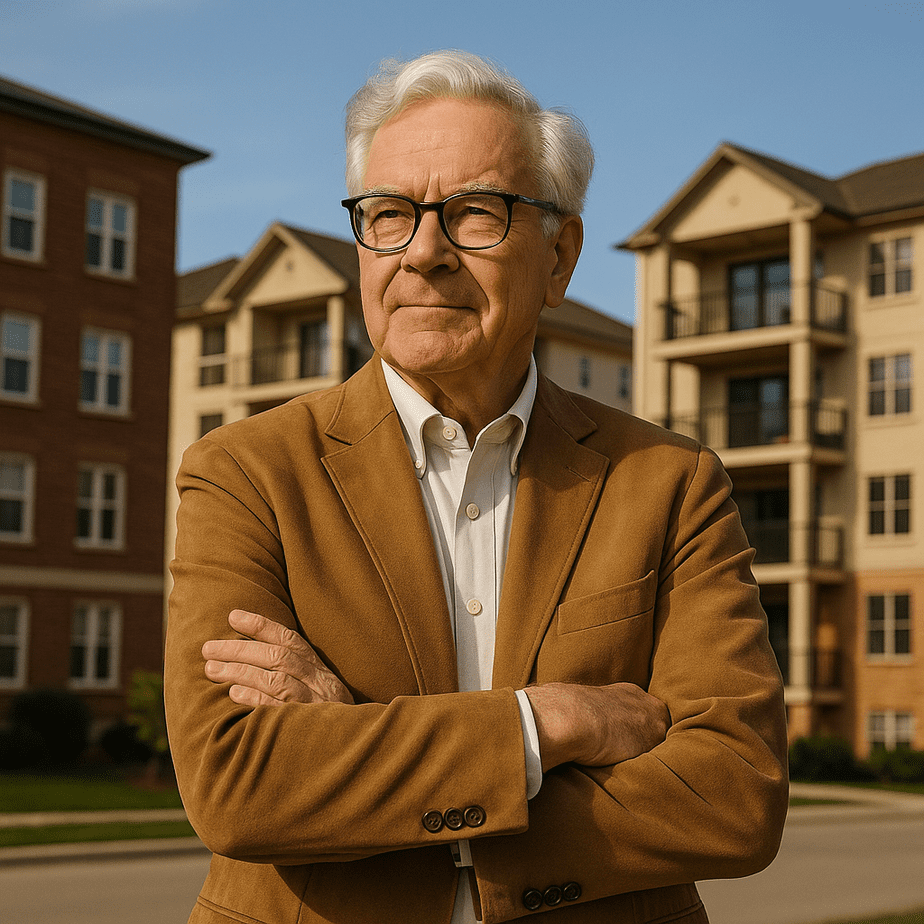

I remember my grandpa Joe, a man who built everything from scratch. He wasn’t fancy, didn’t chase flashy stocks, and wasn’t a fan of “get rich quick” schemes. His secret? Dirt. Specifically, owning it. He started with a single rental property in the 1960s, and by the time he passed, that one property had blossomed into a small portfolio providing a comfortable life for him and, eventually, helping put me through college. I used to tease him about being a “landlord,” but he’d just chuckle and say, “Son, land is the one thing they aren’t making more of.” He was right. Over the years, I’ve seen trends come and go, the stock market rollercoaster, but real estate investment has consistently proven to be a bedrock for building lasting wealth. Today, I want to share what I’ve learned, not as a financial guru, but as someone who’s been in the trenches, getting my hands dirty – literally and figuratively – with brick and mortar. We’ll explore why it’s a particularly solid choice for those already in a comfortable financial position, a strategy often favored by folks like Warren Buffett, and why it continues to be a powerful path to financial freedom.

Why Real Estate Still Reigns Supreme

Let’s be real; the financial landscape is constantly shifting. New investment options pop up daily, promising huge returns. But year after year, real estate investment stands its ground. There’s a reason it’s been a cornerstone of wealth building for generations. It’s not about getting rich overnight; it’s about steady, dependable growth. It’s about creating an asset that provides tangible value and, importantly, generates cash flow. I’ve been involved in real estate for nearly 20 years now, starting with helping my dad manage some of Grandpa Joe’s properties, and eventually branching out on my own. I’ve seen a lot, learned a lot, and made a few mistakes along the way (more on those later!). But through it all, the fundamental principles of successful real estate investment have remained the same.

The Tangible Nature of the Investment

Unlike stocks, which can feel abstract and tied to the whims of the market, real estate is *concrete*. You can see it, touch it, and improve it. There’s inherent value in that. It’s a physical asset that people need—shelter is a fundamental human requirement. This demand provides a level of security that’s hard to find elsewhere. I recall one particularly volatile period in the stock market back in 2008/2009. While friends were losing sleep over their portfolios, my rental properties continued to generate income, providing a much-needed buffer. This isn’t to say real estate is immune to downturns, but its connection to a basic need makes it generally more resilient. If you’re looking for a stable, long-term investment, check out our guide to diverse investment strategies – it’s not all about property, but it’ll help you put things in perspective.

Cash Flow & Appreciation – The Dynamic Duo

What I love about real estate investment is the potential for two streams of income: cash flow and appreciation. Cash flow is the money you earn each month from rental income after covering expenses like mortgage payments, property taxes, and maintenance. Appreciation is the increase in the property’s value over time. Ideally, you want both! I’ve seen properties that barely appreciated for years, but still provided a fantastic monthly cash flow. And then there are those rare gems that appreciate rapidly *and* generate strong cash flow – those are the ones you dream about! Understanding how to analyze properties to identify these opportunities is key – and that’s where proper due diligence comes in. You can learn about property valuation techniques on our site to help you with this crucial step.

Warren Buffett’s Real Estate Playbook

It’s no secret that Warren Buffett, arguably the greatest investor of our time, has a significant stake in real estate. While he’s famous for his stock picks, his investments in companies like Clayton Homes (a manufactured housing company) demonstrate a clear understanding of the power of property. He doesn’t necessarily focus on flipping houses for quick profits; he looks for long-term, sustainable value. His approach is about identifying underserved markets and building businesses that provide a valuable service. I’ve often drawn inspiration from his philosophy of buying “wonderful companies at fair prices” – in real estate, this translates to finding quality properties in good locations at reasonable prices. Investopedia has a good overview of Buffett’s real estate holdings.

Focus on Long-Term Value, Not Short-Term Gains

Buffett’s strategy isn’t about speculation. It’s about identifying properties or businesses with lasting value. He isn’t trying to time the market; he’s trying to build a portfolio of assets that will generate income and appreciate over the long haul. That’s a lesson I’ve really taken to heart. I used to get caught up in trying to predict market fluctuations, attempting to buy low and sell high. It was stressful and, frankly, often unsuccessful. Now, I focus on finding solid properties with good fundamentals – strong locations, good construction, and potential for growth – and then holding onto them for the long term. It’s a much more peaceful and, ultimately, more profitable approach.

Identifying Undervalued Opportunities

Buffett is a master at identifying undervalued opportunities. In real estate, this means finding properties that are priced below their intrinsic value – perhaps because they need some repairs, are in a less-desirable neighborhood (with potential for improvement), or because the seller is motivated. I once stumbled upon a distressed property that had been vacant for years. It needed a complete renovation, but the location was fantastic – a rapidly gentrifying neighborhood with strong rental demand. After careful analysis, I realized the potential return was significant. It was a lot of work, but it paid off handsomely, both in terms of rental income and eventual resale value. This is where a good real estate agent and a qualified property inspector become invaluable. Find a trusted real estate agent through our directory.

For Millionaires: Why Real Estate is Particularly Attractive

Now, let’s talk specifically about why real estate investment is particularly appealing to those who’ve already achieved a certain level of financial success. If you’ve already built wealth, you’re likely in a position to leverage your resources to acquire higher-quality properties, often with less reliance on traditional financing. This opens up a world of opportunities, from commercial properties and multi-family units to larger-scale development projects.

Tax Advantages: A Significant Benefit

One of the biggest advantages of real estate for high-net-worth individuals is the tax benefits. Depreciation allows you to deduct a portion of the property’s value each year, reducing your taxable income. You can also deduct expenses like mortgage interest, property taxes, and maintenance costs. And when you eventually sell the property, you may be eligible for capital gains tax breaks. I strongly recommend consulting with a qualified tax advisor to fully understand the tax implications of real estate investment – it can make a significant difference to your overall returns. There are many nuances and strategies that can be employed to minimize your tax liability. A good accountant specializing in real estate investment is worth their weight in gold. You can find more resources on tax planning here.

Diversification and Portfolio Stability

For millionaires, diversification is key to protecting and growing wealth. Adding real estate to your portfolio can help to reduce overall risk. Real estate often moves independently of the stock market, providing a hedge against economic volatility. I’ve found that having a mix of stocks, bonds, and real estate provides a solid foundation for long-term financial security. It’s like building a three-legged stool – if one leg wobbles, the others can keep it standing. It’s a prudent strategy for anyone, but particularly important for those with significant wealth to protect. This diversification is one of the key reasons many high-net-worth individuals consider real estate investment a smart move.

Common Mistakes to Avoid (Learned the Hard Way!)

I’ve made my share of mistakes over the years, and I’m happy to share them so you can avoid them. Real estate isn’t always glamorous. It can be messy, frustrating, and time-consuming. But the rewards can be well worth the effort, *if* you avoid some common pitfalls.

Underestimating Repair and Maintenance Costs

Trust me on this one: things *will* break. And repairs will always cost more than you expect and take longer than you anticipate. I once bought a property thinking it was in good condition, only to discover a leaky roof and a crumbling foundation. The repair bills were substantial and ate into my profits for months. Always factor in a generous buffer for repairs and maintenance when calculating your potential return. A good rule of thumb is to budget at least 1% of the property’s value per year for maintenance, and potentially more for older properties. This is a lesson I learned the hard way.

Ignoring Location, Location, Location

It’s a cliché for a reason. Location is paramount. A beautiful property in a bad location will struggle to attract tenants or appreciate in value. Look for properties in areas with strong schools, good job markets, and convenient access to amenities. Do your research and understand the local market trends. I almost bought a property in a seemingly quiet suburban area, only to later discover plans for a massive highway expansion nearby. That would have significantly impacted the property’s value and desirability. Always check local zoning regulations and future development plans.

The Future of Real Estate Investment

The real estate market is evolving, with new technologies and trends emerging all the time. The rise of proptech (property technology) is transforming the way we buy, sell, and manage properties. Online platforms are making it easier to find investment opportunities, analyze properties, and connect with tenants. The National Association of Realtors offers excellent resources on market trends and emerging technologies in real estate. Despite these changes, the fundamental principles of successful real estate investment remain the same: focus on long-term value, do your due diligence, and manage your risk. I believe that real estate will continue to be a safe and profitable investment option for millionaires – and for anyone looking to build lasting wealth.

So, what are you waiting for? If you’re considering adding real estate investment to your portfolio, do your research, seek professional advice, and take the plunge. It’s a decision you likely won’t regret. And remember, don’t be afraid to get your hands dirty. Grandpa Joe would be proud. If you need help getting started, explore our additional resources on real estate investing and consider scheduling a consultation with one of our advisors.

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.