Indian companies are increasingly investing abroad as a strategic move to diversify their operations and mitigate risks.

| Photo Credit:

adventtr

Even as questions are being raised by the Centre about the record high overseas direct investments (ODIs) in FY25,businesslineanalysis shows that the surge was led by large corporates. Companies such as Tata Steel, Vedanta, Samvardhana Motherson International, Bharat Petroresources and Biocon Biologics, with widespread overseas operations, led the outflows last fiscal year.

There was an 80 per cent increase in ODI flows from India to $25.6 billion in FY25. RBI data show that Tata Steel alone accounted for 12 per cent of these outflows, with $3 billion ODI commitment to Singapore. Vedanta and Samvardhana Motherson’s ODIs commitments were $1.8 billion each, spread across multiple countries including Saudi Arabia, Germany, the Netherlands, the UAE, and Mauritius. ODIs reported were across sectors and geographies with purpose mentioned as money sent either for JVs or for wholly-owned subsidiaries.

Sun Pharma, Restocraft Hospitality, Oravel Stays, Praj Industries and Mahindra & Mahindra are the other companies that clocked highest outward FDI in FY25.

Tata Steel and Vedanta have operations in multiple countries and ODIs could relate to that. Samvardhana Motherson has subsidiaries in both Germany and the Netherlands. Bharat Petroresources and Biocon Biologics also have entities set up in locations corresponding to the ODI flows.

Why the surge?

“Indian companies are increasingly investing abroad as a strategic move to diversify their operations and mitigate risks. These investments enable them to enhance product and service portfolios and gain access to new markets,” Gaurav Dayal, partner, Lakshmikumaran Sridharan attorneys, said. ODIs have also been supported by the liberalisation of overseas investment regulations in 2022, he adds.

A large portion of ODIs went to Singapore, which saw $5.8 billion ODI in FY25 up from $4 billion in the previous year. The UAE, Mauritius, the US also saw notable increases in ODI inflows in FY25. The top five countries — Singapore, Mauritius, the US, the Netherlands and the UK — accounted for 57 per cent of the total ODI flows in FY25.

Birbahadur Sachar, Partner, JSA Advocates and Solicitors, says Indian companies also see overseas investment / manufacturing as a way to hedge against increase in local tariffs.

Key hub

“With Singapore becoming one of the key global financial hubs, ODI to Singapore enables Indian companies to invest in other jurisdictions with the benefit of its favourable tax treaties,” he says. Singapore has also become a key destination for HNIs to incorporate and manage their family offices and investments, he adds.

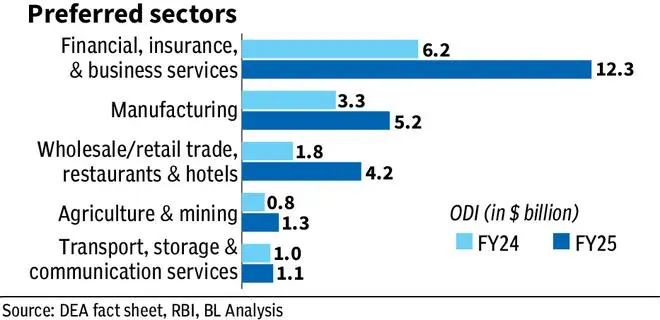

Sectoral data show that financial, insurance and business services accounted for nearly half of all ODI in FY25, doubling from $6.2 billion in FY24 to $12.3 billion. Manufacturing followed with $5.2 billion, while the wholesale and retail trade, restaurants and hotels segment more than doubled its share to $4.2 billion in FY25.

Net FDI inflows into India were muted at $0.4 billion in FY25 essentially because of higher ODIs and increased repatriations even though gross FDI inflows were steady at $81 billion.

Published on June 3, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.