I am holding UCO Bank shares at an average price of ₹38. Should I continue to hold or exit the stock?

Narasingh Mohanty

UCO Bank (₹33): The trend is down. Support is around ₹27 which is holding for now. The stock made a low of ₹26.8 in April this year and has bounced from there. Resistance is at ₹36. A strong break above it will give some relief and take the share price up to ₹45. A strong break above ₹45 will then turn the outlook completely bullish.

Failure to breach ₹36 from here can drag the price down to ₹25 or ₹22 in the next few months. Keep the stop-loss at ₹29 and hold the stock. Move the stop-loss up to ₹35 when the price goes up to ₹38. Move the stop-loss further up to ₹39 when the price touches ₹42. Exit the stock at ₹44.

What is the outlook for PC Jeweller? Can I buy this stock for long term?

T Selvam, Kanyakumari

PC Jeweller (₹12.30): The broader trend is up. The fall from the high of ₹19.60 made in December last year is just a correction within the overall uptrend. Strong support is in the ₹10.50-₹9.50 region. We expect the stock to sustain above this support zone and see a fresh rally. This leg of upmove can take the share price up to ₹23.

Buy the stock now and accumulate at ₹11. Keep the stop-loss at ₹7. Trail the stop-loss up to ₹15 when the price goes up to ₹17. Revise the stop-loss further up to ₹18 and ₹19 when the share price touches ₹20 and ₹21 respectively. Exit the stock at ₹23. Since the price is low, you might be tempted to buy in large quantity. Please be careful about that.

I have Just Dial shares bought at ₹1,050. What is the outlook?

B M Srinivasa, Bengaluru

Just Dial (₹891): The downtrend that was in place since September last year seems to have found a bottom. The support in the ₹750-700 region has held very well. The price action since 2020 indicates a bull channel. The recent bounce from the low ₹700 made in April has happened from just below the channel support level of ₹780.

The bias is bullish. There are good chances to see a rise to ₹1,500 – the upper end of the channel in the next three-four quarters. You can buy more and accumulate now. Keep a stop-loss at ₹570. Trail the stop-loss up to ₹1,040 when the price goes up to ₹1,180. Move the stop-loss further up to ₹1,230 when the price touches ₹1,380. Exit the stock at ₹1,500.

What is the outlook for Texmaco Rail & Engineering?

Dr MP Mithra, Kottayam

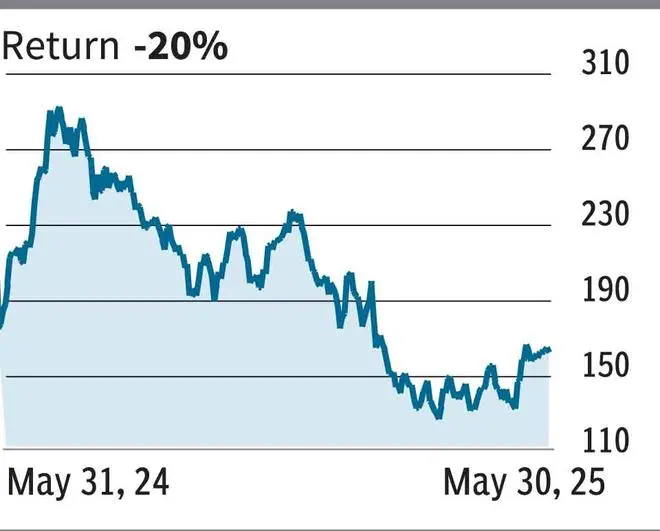

Texmaco Rail & Engineering (₹159): The trend is down since July last year and it is strong. Resistance is in the ₹170-175 region which can cap the upside. We can expect the stock to reverse lower again and resume the broader down trend targeting ₹110. A break below ₹110 can drag the share price further down to ₹92.

Ideally, the stock has to rise above ₹175 to indicate a trend reversal and become bullish. Only then a rise to ₹200 and higher levels will come back into the picture. Wait for the fall to ₹110 or ₹92 and see if the price is reversing higher or not to consider buying this stock. For now, it is better to stay out of this stock.

Send your questions to [email protected]

Published on May 31, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.