After a prolonged period of correction from September 2024, the markets seem to have recovered reasonably well from early April this year. This rally from the bottom has been broad-based, with stocks across market-cap segments participating in the upswing.

The previous highs on standard indices have not been reached, yet. There are still pockets of valuation comfort in the large and mid-cap segments despite the buoyant markets.

In this regard, a large and mid-cap fund may suit investors with an appetite for slightly higher risks in lieu of stronger performance outcomes.

ICICI Prudential Large & Mid Cap fund (ICICI Prudential Top 100 earlier) has a track record of nearly 27 years and has delivered 18.6 per cent (regular plan) compounded annually over this period. The scheme has a track record of delivering consistently above-average performance over the very long term.

Investors can consider the fund for long-term goals of around 10 years or further as the scheme has a mix of value (occasionally contrarian, too) and growth picks.

Taking the SIP route for investing can help ride market volatility and average costs.

Strong track record

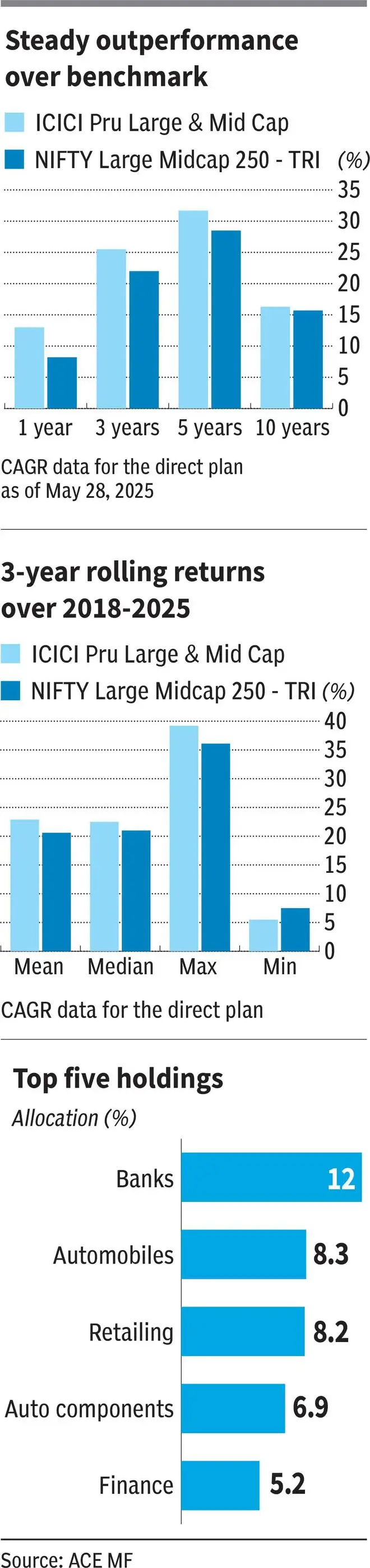

ICICI Prudential Large & Mid Cap fund has been fairly consistent over the years. When 3-year rolling returns are considered from 2018-2025, the fund has delivered 22.9 per cent on an average. The Nifty Large Midcap 250 TRI managed 20.6 per cent over the same period.

Furthermore, on 3-year rolling basis over the aforementioned period, the fund has beaten its benchmark nearly 78 per cent of the time.

ICICI Prudential Large & Mid Cap has given more than 12 per cent returns on a 3-year rolling basis from 2018 to 2025 over 93 per cent of the time and in excess of 15 per cent for nearly 90 per cent of the time.

A monthly SIP in the fund for the past 10 years would have given annual returns of 19.8 per cent (XIRR). Monthly investments in the benchmark index for the same period would have delivered 18 per cent.

All data pertain to the direct plan of the fund.

The fund has an upside capture ratio of 94.1, indicating that its NAV rises a bit less than the benchmark during rallies. But more importantly, it has a downside capture ratio of 58.3, suggesting that the scheme’s NAV falls much less than the Nifty Large Midcap 250 TRI during corrections. A score of 100 indicates that a fund performs in line with its benchmark. This inference is based on data from May 2022 to May 2025.

Smart portfolio mix

ICICI Prudential Large & Mid Cap fund takes a relatively flexible approach in setting its overall market-cap mix. Funds in the category are expected to invest at least 35 per cent each in large and mid-cap stocks.

While the portfolio’s tilt over the years has generally been towards large-caps, the fund has also introduced small-caps into the portfolio in a significant way over the past 12 months or so. In the current mix, large-caps account for over 45 per cent of the portfolio, mid-caps for almost 37 per cent and small-caps for a little over 12 per cent.

This market-cap mix helps the fund to participate in broader market rallies. But the weightages to individual stocks are low even among the top holdings. At 92 stocks, the fund has a fairly well-diversified portfolio.

In terms of sector holdings, banks always featured on top of the list. Subsequent segments are juggled smartly by mixing a blend of growth and at times value/contrarian picks.

When pharma and biotech stocks looked attractive from a valuation perspective, the fund hiked stakes in these sectors in the middle of 2024. Subsequently, it has taken to automobiles and retailing (a beaten down segment) with significant exposures.

By limiting stakes in IT and FMCG segments over the past couple of years, the fund was able to avoid a streak of underperformance that these sectors faced.

Even in terms of sector exposures, all segments other than banks have much less than 10 per cent weightage, making for a diffused portfolio with managed risk levels.

Cash, debt and others are limited to about 5-6 per cent of the portfolio across market cycles.

On the whole, a flexi/multi-cap approach, a mix of investment styles with valuation still anchoring the holdings and a well-diversified portfolio work well for the fund.

Published on May 31, 2025

Anurag Dhole is a seasoned journalist and content writer with a passion for delivering timely, accurate, and engaging stories. With over 8 years of experience in digital media, she covers a wide range of topics—from breaking news and politics to business insights and cultural trends. Jane's writing style blends clarity with depth, aiming to inform and inspire readers in a fast-paced media landscape. When she’s not chasing stories, she’s likely reading investigative features or exploring local cafés for her next writing spot.